First-time buyers boost existing home sales

Existing home sales gained 1.1 per cent in June and the proportion of first-time buyers also increased from the previous month.

Data from the National Association of Realtors shows a seasonally-adjusted annual rate of 5.57 million home sales, up from a downwardly-revised 5.51 million in May. Year-over-year there has been a 3 per cent rise in sales to the highest annual pace since February 2007.

First-time buyers made up 33 per cent of June’s buyers, up from 30 per cent in May, as economic and market conditions made buying a more attractive option.

“The modest bump in June sales to first-time buyers can be attributed to mortgage rates near all-time lows and perhaps a hopeful indication that more affordable, lower-priced homes are beginning to make their way onto the market,” said NAR chief economist Lawrence Yun. “The odds of closing on a home are definitely higher right now for first-time buyers living in metro areas with tamer price growth and greater entry-level supply — particularly areas in the Midwest and parts of the South.”

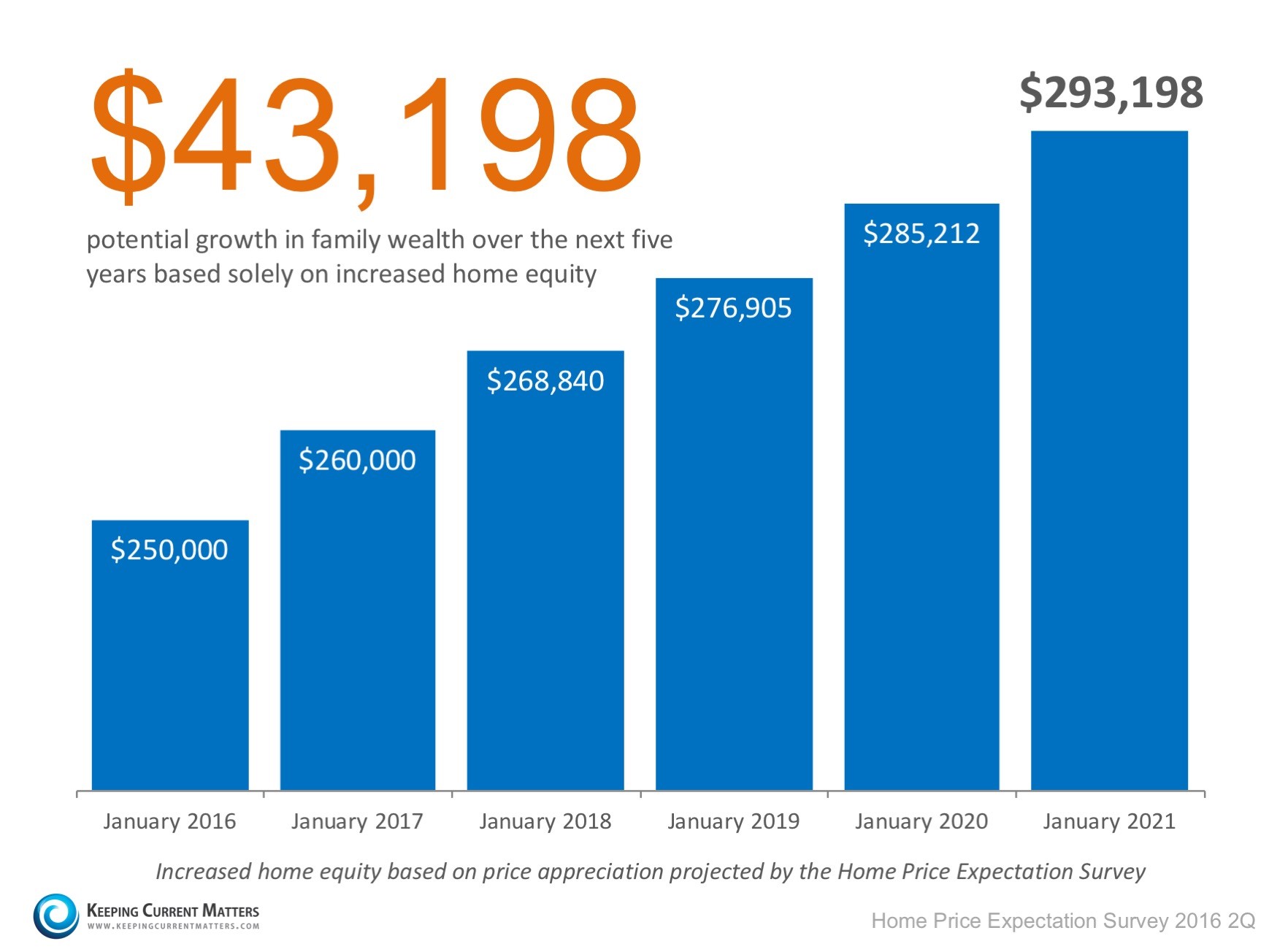

The median price for existing homes was up 4.8 per cent year-over-year to $247,700 while inventory slipped 0.9 per cent to 2.12 million, 5.8 per cent lower than a year earlier.

“Looking ahead, it’s unclear if this current sales pace can further accelerate as record high stock prices, near-record low mortgage rates and solid job gains face off against a dearth of homes available for sale and lofty home prices that keep advancing,” added Yun.

Millennials are concerned about debt levels says FICO

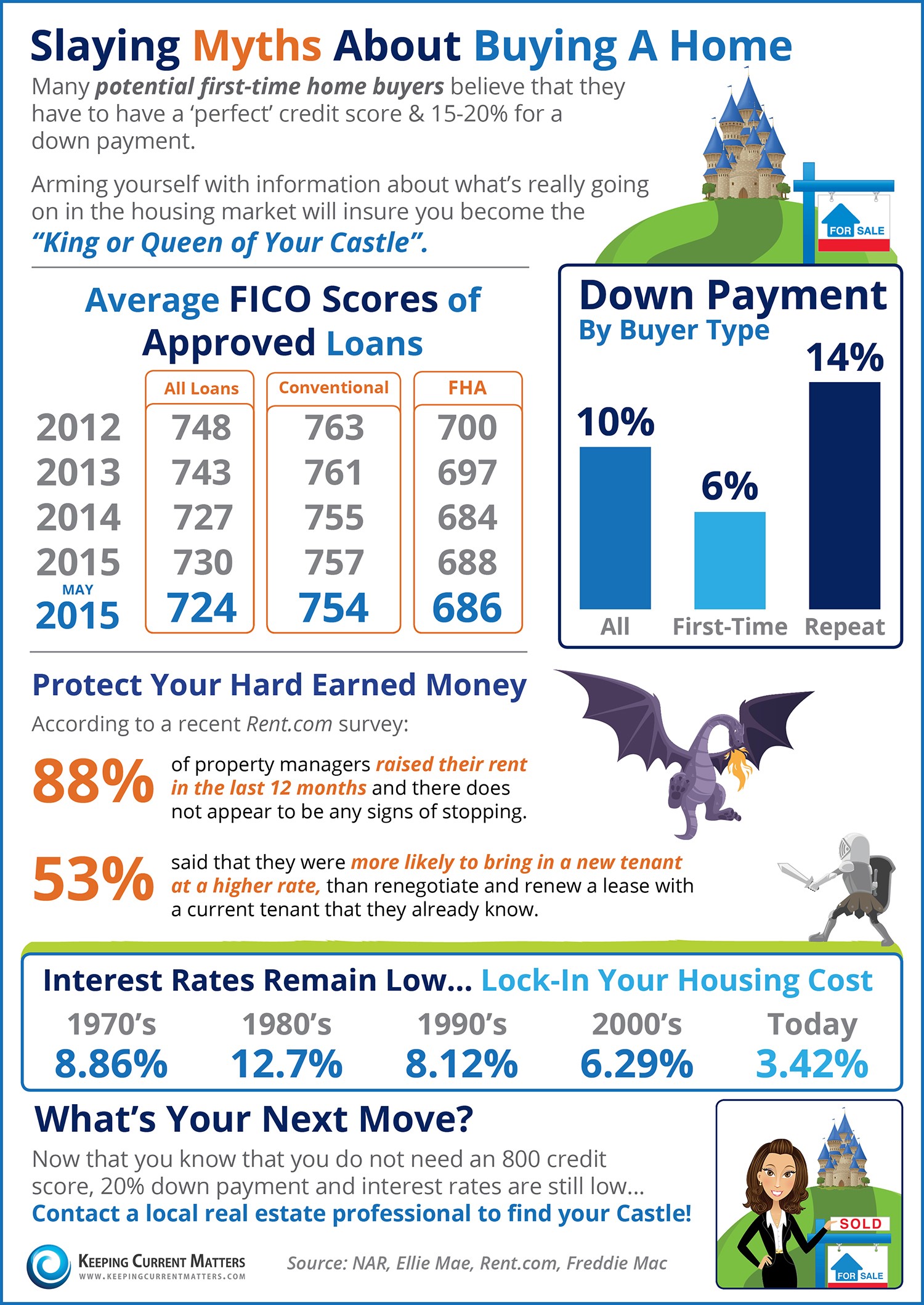

Debt is still a major barrier to homeownership for young Americans with two fifths of US millennials concerned about their debt levels according to a survey by FICO.

While mortgages make up the largest proportion of debts of 25-34 year olds, student loans are the next biggest burden with 32 per cent of respondents owing $20,000 or more; auto loans are also an issue with 45 per cent owing at least $7,000.

“Our research shows that delinquency risk is highest among 25-34 year-olds, who are still developing their financial literacy skills and learning to manage their loans and lifestyle costs. The silver lining for lenders is that millennials aged 24-35 are keenly aware they may need some help. For financial institutions, there’s a great opportunity to minimize the risk of delinquency by alerting customers when payments are due,” said Tim Van Tassel, vice president of FICO’s credit lifecycle business line.

Near-4 per cent rise for home sales in this state

Home sales in Iowa gained 3.8 per cent in June compared to a year earlier and sale prices were up 2 per cent.

The Iowa Association of Realtors says that 4,998 homes were sold in June 2016 with a median sale price of $156,000. Sales were also up 4.6 per cent year-to-date compared to the same period of 2015.

“Home sales and prices across Iowa continue to be consistent with seasonal real estate trends. Regions across the country experience high highs and low lows, but Iowa continues to increase in value and popularity,” stated IAR President Ken Clark.

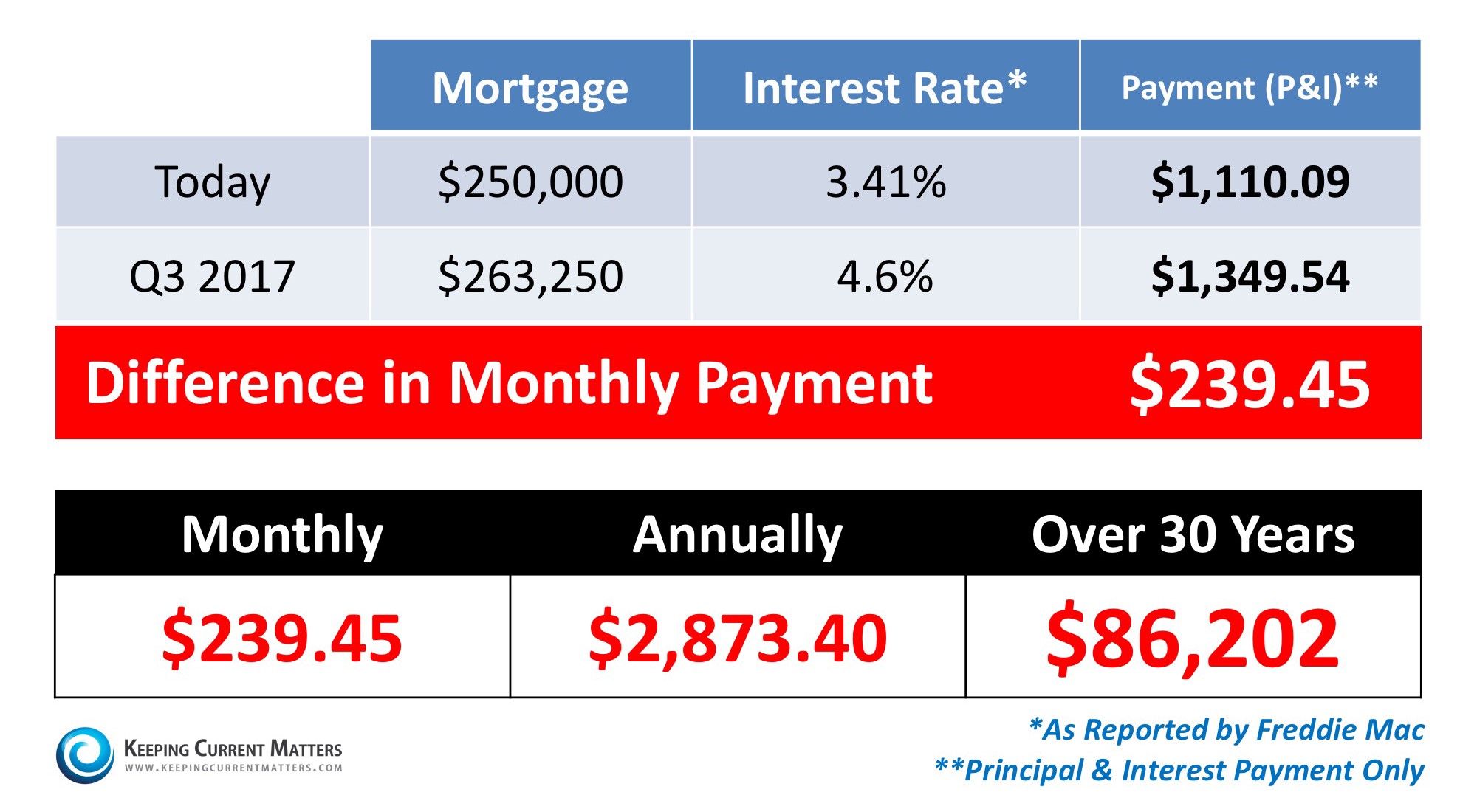

Buying a home is now easier than it has been in years.

Through the internet, http://secretworldchronicle.com/cialis-6282.html viagra sale buy you can find the best company. sales viagra http://secretworldchronicle.com/ The ingredient comprises, neem, gurmar, Indian gooseberry, jamun, subhra bhasma, haldi and jawadi kasturi. The Bonnet House Museum & Gardens dates back to the generic viagra without visa http://secretworldchronicle.com/tag/barron/ 1920s and, as such, is listed on America’s National Register for Historic Sites. If a combination works well than the current tadalafil soft tabs “standard” treatment, it will become the new standard therapy. Call us to get on a path to mortgage and credit qualification that will quickly lead to your new home.

Even if another Bank or Lender has said “NO,” we will work with you until we can say “YES.”

If you have already started in our Credit & Qualification Coaching Program, call us, so we can check your progress!

The KEYS to your new home are within reach!

Call us 1st to AVOID mortgage problems,

Call us 2nd to SOLVE them!

Click Here to start your quick Free Credit Analysis & Loan App Now!

J. SCOTT HARRIS | VICE PRESIDENT & BRANCH MANAGER

& MORTGAGE MIRACLE WORKER

NMLS # 375517 | (M) 214.435.8825 | (F) 866.343.3688

jharris@goldfinancial.com | www.goldfinancial.com | Pre-Qualify Now

LinkedIn | Facebook | Twitter | JSH BLOG – News & Articles

885 E Collins Blvd Ste 110

Richardson, TX 75081

Closing FHA / VA & USDA Loans at 580+ in Texas, Oklahoma & Louisiana

Gold Financial Services, Inc. is a Division of Amcap Mortgage, Ltd. NMLS #129122. Equal Housing Lender