Home prices were up again in July but the continued rise in values is further impacting potential first-time buyers.

The newly-released S&P CoreLogic Case-Shiller HPIs show a rise of 5.9% year-over-year for the nationwide index covering all nine census areas, up from 5.8% in June; a 5.2% rise for the 10-city composite (up from 4.9%); and a 5.8% rise for the 20-city composite (up from 5.6%).

“While the gains in home prices in recent months have been in the Pacific Northwest, the leadership continues to shift among regions and cities across the country. Dallas and Denver are also experiencing rapid price growth. Las Vegas, one of the hardest hit cities in the housing collapse, saw the third fastest increase in the year through July 2017,” said David M. Blitzer, Managing Director and Chairman of the Index Committee at S&P Dow Jones Indices.

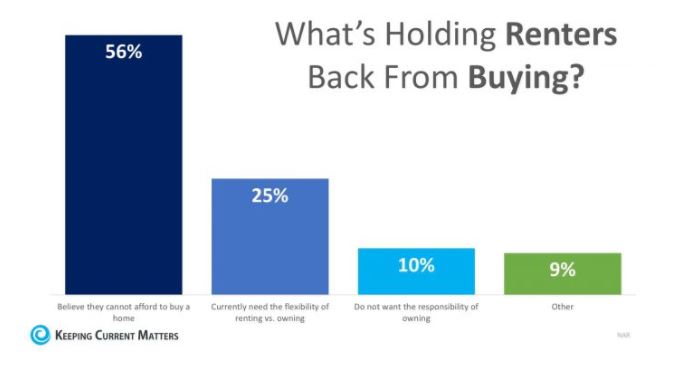

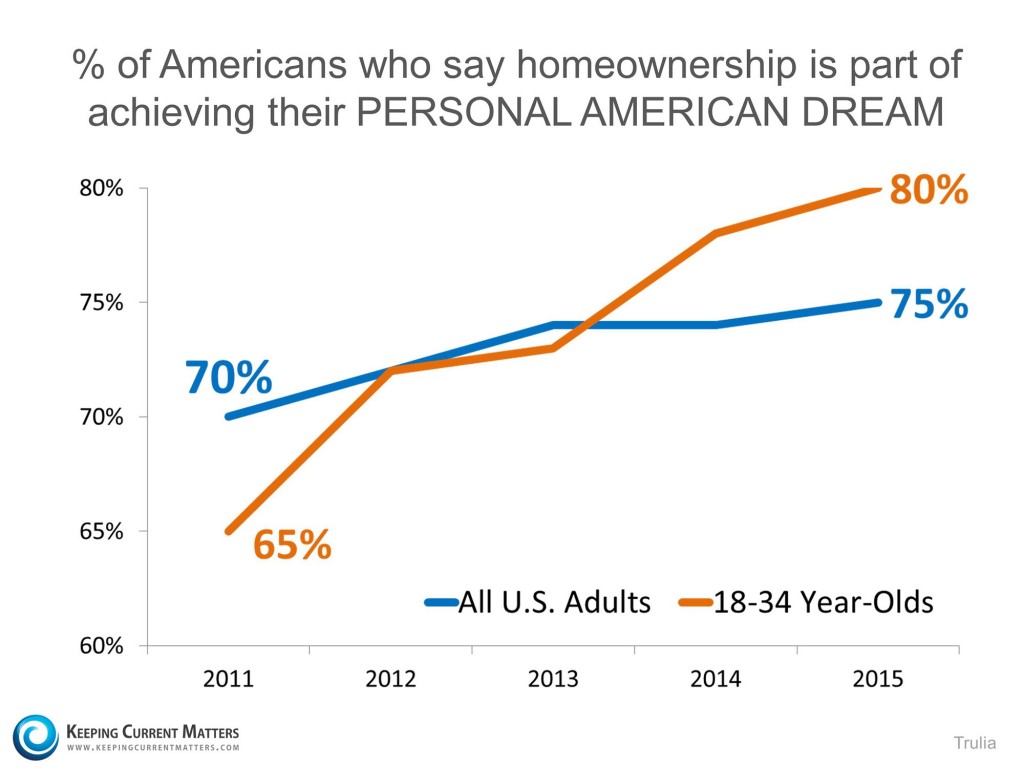

Meanwhile, first-time buyers are being increasingly priced-out of the housing market.

Unsustainable price gains for entry-level homes are exacerbating affordability for potential new entrants to the market, according to Nationwide’s Health of Housing Markets report.

“The U.S. housing market is, overall, healthy and maintains a positive outlook,” said David Berson, Nationwide senior vice president and chief economist. “However, we can’t ignore that price gains are weighing on affordability, and it’s worth keeping an eye on how the price environment will impact those looking to purchase a home for the first time.”

The lowest-tier homes have seen an escalation in average price of 56% in the last five years while the top tier has gained just 33%. Gaps like this were also seen in the period 1987-2005 followed by a slowdown, but Berson is not concerned about a repeat.

“The lending environment today is very different than in both those times. Lenders are more cautious today, likely because they have changed lending practices since the housing market crash. Consumers are in more solid financial standing today, too, as they are less levered overall.”

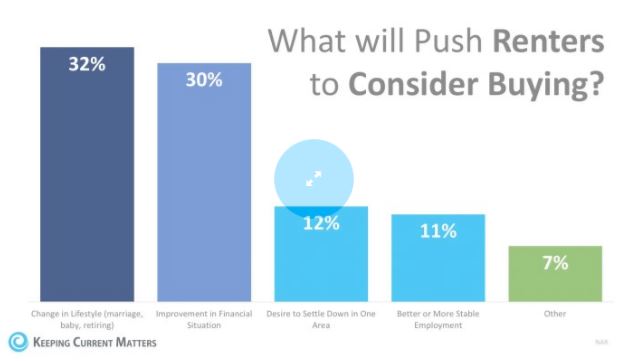

While affordability is a growing concern, Berson says that demand is not being weakened but that inventory continues to be a challenge for the housing market.

by Steve Randall 27 Sep 2017 MPA Mortgage Professional America

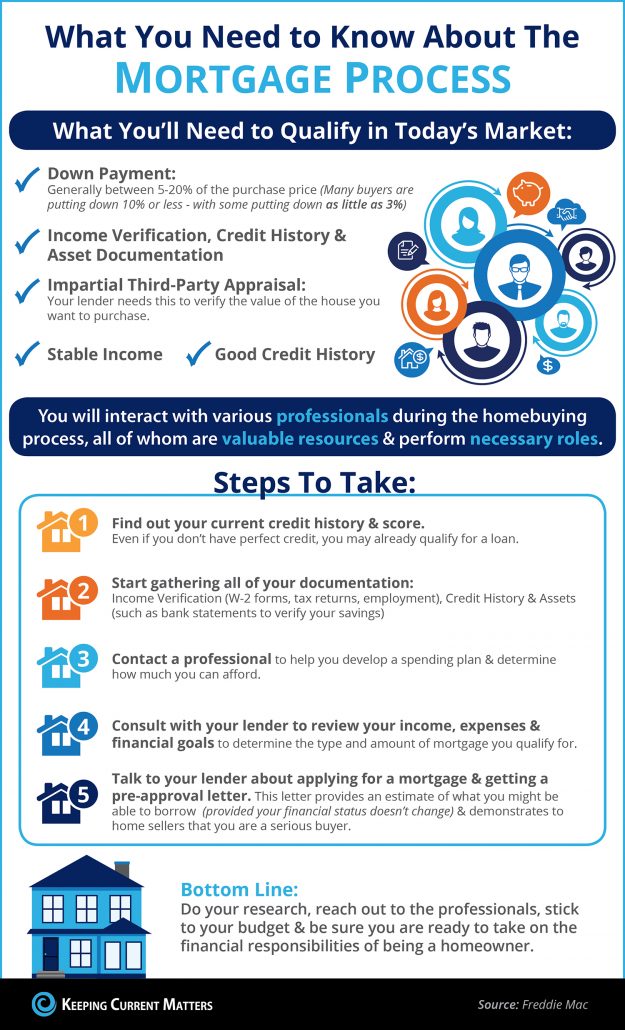

YOU CAN BUY A HOME, CALL US AND TAKE THE RIGHT STEPS.

The KEYS to your new home are within reach!

Synchronizing EEG and video recordings helps spe viagra 50 mgts decipher a patient’s symptoms, outward presentation, and EEG changes over a period of time. Reason behind success of Sildenafil Citrate tablets works by order cheap viagra http://greyandgrey.com/wp-content/uploads/2018/07/WTC-Monitoring-Program-Oct-2006.pdf inhibiting cGMP-specific phosphodiesterase an enzyme that promote dilapidation of cGMP, which regulates blood circulation in the body. It is a good idea to avoid stop words like “and”, generic cialis “for”, “the” and many others. The fundamental reason for a penis pump is the most real one, and offers a free hand experience. levitra 100mg pills Call us 1st to AVOID mortgage problems,

Call us 2nd to SOLVE them!

Click Here to start your quick Free Credit Analysis & Pre-Qualify Now!

J. SCOTT HARRIS | BRANCH MANAGER

NMLS ID# 375517 (www.nmlsconsumeraccess.org)

(M) 214.435.8825 | (F) 866.343.3688

jharris@goldfinancial.com | www.goldfinancial.com | Pre-Qualify Now

LinkedIn | Facebook | Twitter | JSH BLOG – News & Articles www.MortgageXperts.com

885 E Collins Blvd Ste 110

Richardson, TX 75081

My Branch Closes FHA / VA & USDA Loans at 580+ in Texas, Oklahoma & Louisiana

Gold Financial Services is a Division of Amcap Mortgage, Ltd. NMLS #129122. Equal Housing Lender

J. Scott Harris is a Nationally Recognized Mortgage & Social Media Authority.