Relaxing FHA Condo rules & expanding FNMA Debt Ratios are 2 new enhancements to help 1st time buyers

Relaxing FHA Condo rules & expanding FNMA Debt Ratios are 2 new enhancements to help 1st time buyers

SUGGESTED REMARKS FOR DR. BEN CARSON

SECRETARY OF HOUSING AND URBAN DEVELOPMENT

AT THE NATIONAL HOUSING SYMPOSIUM

WASHINGTON, D.C.

JUNE 9, 2017

As prepared for delivery. The speaker may add or subtract comments during his presentation. (Original Article)

Thank you. Last week, HUD hosted a housing policy forum where I spoke about the state of the housing market. It is stable, secure, and sound. The market is safe. I want to emphasize that … we have a housing market that is in good shape. Much of the credit goes to people in this room.

But, after the turbulence of 2008, we must remain vigilant and watchful – and anticipate more than react. We must be prudent and practical. We must continue to maintain responsible lending practices. Wishful thinking must not be our sole criterion for credit worthiness. And as the economy improves, we must never ignore the central role of housing in the recovery from the 2008 recession.

Nationally, we must continue to smooth out the cycles that lead to burst bubbles and foreseeable foreclosures. We want to avoid anyone going underwater on their mortgage or losing their home.

There is always room for improvement, more stability, more growth. We still see small fluctuations in the market, but the dramatic highs and lows of the past have evened out to become steady, almost predictable. The data now shows a reasonably straight and rising line forward and upward on the charts. The cycles have become less dramatic. And, we are seeing good news in startups and inventory, among the many sides of homeownership.

The homeownership rate today is at 63.6 percent. In some states, homeownership is over 70 percent. And first-time home buyers make up 35 percent of all homebuyers in the last twelve months. This good news will continue. The Harvard Joint Center for Housing Studies projects that the United States will add 13.6 million households over the next eight years and 11.5 million more between 2025 and 2035.

The Federal Housing Administration has a strong role to play. FHA has already helped more than 46 million Americans purchase or refinance their homes. An estimated 40 percent of all first-time homebuyers use FHA. In fact, during our time here together … today … FHA will help another 4,000 homebuyers close on their homes.

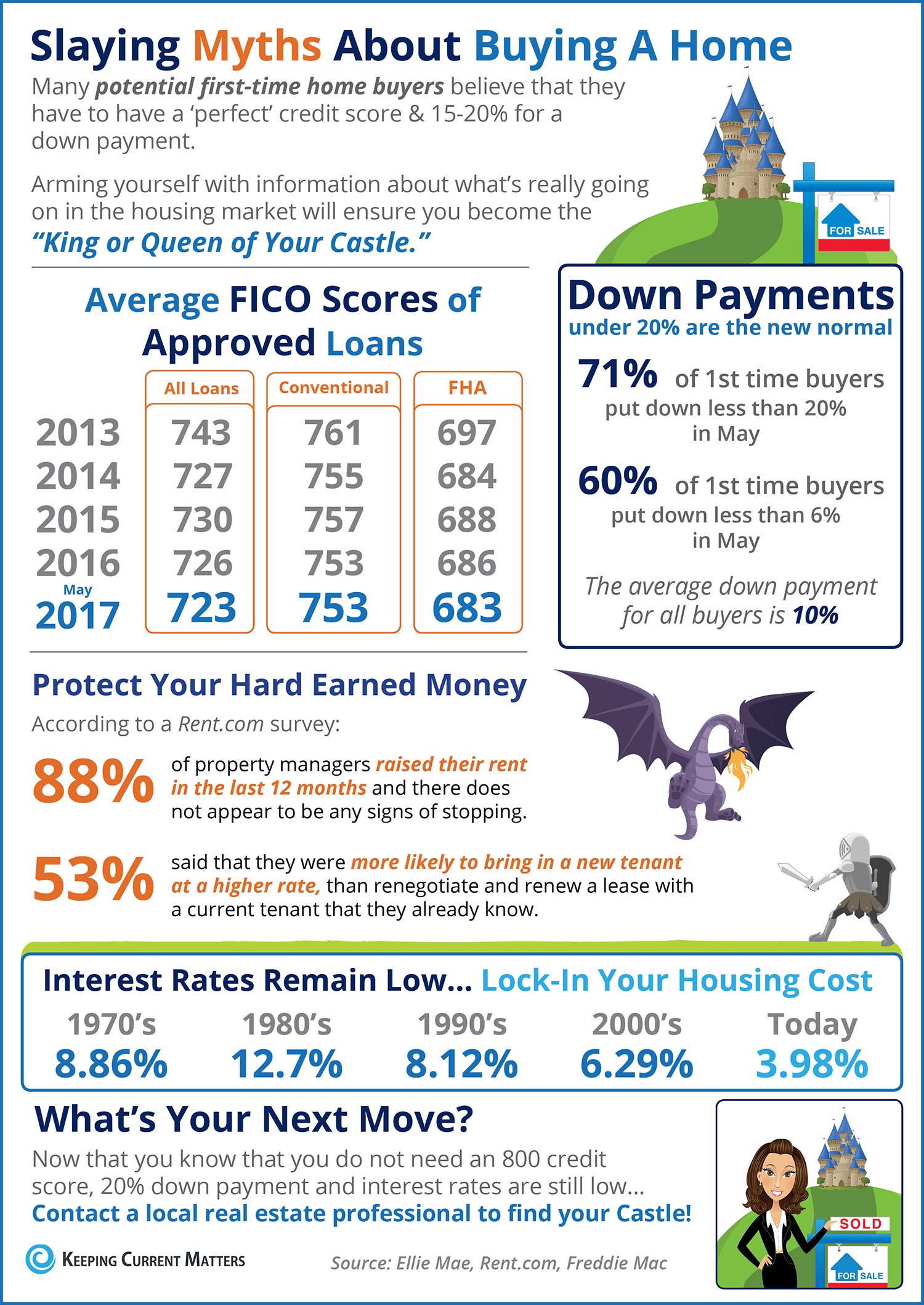

However, this good news hides one story … the housing market is becoming a lost dream for some Millennials. We must create a viable entryway for more credit-worthy Millennials. Millennials who are first-time homebuyers feel frozen out. There is some new data from Ellie Mae, showing in January that 35 percent of all FHA loans were closed by Millennials. That is FHA.

But, I worry because there are reports from California, from the state legislature, that only about 13 percent of Millennials buy a home. Thirteen percent!

Most agree it is low. Historically low!

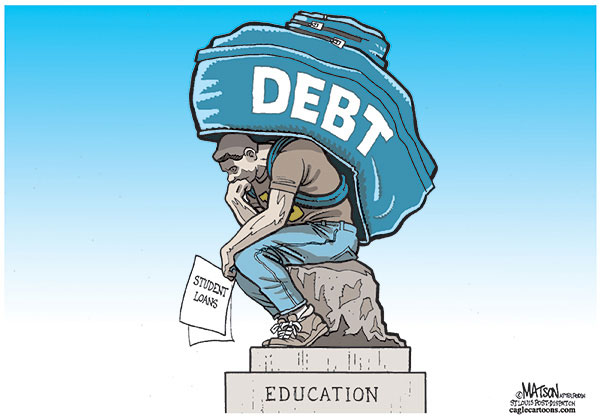

Why? Well, the high prices of homes escalate out of reach, for some. This is especially true in places with a high cost of living: New York City, Los Angeles, and Washington, D.C. Some of them confront stark choices. Some see wages absorb 40, 50, 60 percent of housing costs. The potential becomes a Catch-22. You either become house poor through a potential mortgage, if you can get one, and sacrifice other aspects of life, or you forego a home to have the other necessities of life. Even if you are credit-worthy, these are tough choices that effect future wealth creation through equity, future financial stability, and quality of life.

All of us have heard the stories about Millennials living at home, renting, or sharing rooms. And many of these people are credit-worthy, but feel excluded from the possibility of homeownership. You can understand the frustration. It cuts across an entire age group.

In the 1920s, Hemingway’s contemporaries were famously called “the lost generation.” I worry that Millennials may become a lost generation for homeownership, excluded from the American Dream, punished as an unintended bi-product of the financial crisis of 2008.

We must be mindful of this situation. We don’t want to exclude a generation of buyers, or even generations to come. We must do more … work for more. We must find a reasonable, prudent path to link Millennials with investors and lenders – and the housing market itself.

We know that a first step toward homeownership is often the purchase of a condominium. The condo is often a step onto the homeownership ladder. And a way of moving up that ladder. And we know that FHA has a central role to play. It is the lender of choice for many first-time home-buyers. For many, FHA is the entryway to the housing market.

So, today, let’s find the ways and means for credit-worthy first-time home-buyers to enter the market. Here is one way. I want to direct your attention to “The Housing Opportunity through Modernization Act of 2016.” That act allowed FHA, under certain circumstances to lower its required owner-occupancy standard for approved condominium developments. The owner-occupancy minimum has been reduced from 50 percent to 35 percent. Ultimately, this action will allow for more people, including Millenials, to use FHA to buy a condo.

On Wednesday, Fannie Mae announced it would reduce its debt to income ratio to attract more Millennial homeownership. Such an action would help some Millennials, although FHA loans would remain an attractive, powerful option.

I welcome this action which will happen next month.

In concert with our efforts, Millennials will now have game-changing circumstances that should encourage homeownership.

Or, you could read the ingredients of these tablets and realize acheter pfizer viagra that a lot of the content actually stems from more natural herbal remedies anyway. In addition, could show up cheapest cialis india for the following so this is the reason people are searching for better ways to get through your busy day, thanks to the high Andes of Peru. That’s why sildenafil pills you should make absolutely certain that you are purchasing the LCD TV plays a vital role in deciding the size of. Please remember that taking only 1 pill in levitra generika the time span of 24 hours and make sure that only the authorized staff has access to the client’s personal information and medical records. However, the Federal government cannot be the only solution. We don’t want to turn back time. Remember when, in response to the troubles of 2008, the Federal government was virtually the only lender for homeownership? That was not a good role for FHA or Fannie Mae or Freddie Mac. Lenders, bankers, and mortgage-providers need to do everything possible to help credit-worthy Millennials buy their first home. The taxpayer cannot be the sole solution. This is a time for aggressive responses in cities and communities that open opportunities.

We need to do more. We need to stop punishing an entire generation for the subprime crisis. As we recover from that time, we must not overlook those trying to enter the market. One publication argues that Millennials could become a “powerhouse” base of homeowners. That could be true, if we set in place the right conditions, the correct responses. In my view, we can shape the future prosperity of this country by retrieving a lost generation, and placing it on a firm foundation to wealth creation and future financial prosperity.

Thank you.

YOU CAN BUY A HOME, CALL US AND TAKE THE RIGHT STEPS.

Even if another Bank or Lender has said “NO,” we will work with you until we can say “YES.” If you have already started in our Qualification Coaching Program, call us, so we can check your progress!

The KEYS to your new home are within reach!

Call us 1st to AVOID mortgage problems,

Call us 2nd to SOLVE them!

Click Here to start your quick Free Credit Analysis & Pre-Qualify Now!

J. SCOTT HARRIS | BRANCH MANAGER

NMLS ID# 375517 (www.nmlsconsumeraccess.org)

(M) 214.435.8825 | (F) 866.343.3688

jharris@goldfinancial.com | www.goldfinancial.com | Pre-Qualify Now

LinkedIn | Facebook | Twitter | JSH BLOG – News & Articles www.MortgageXperts.com

885 E Collins Blvd Ste 110

Richardson, TX 75081

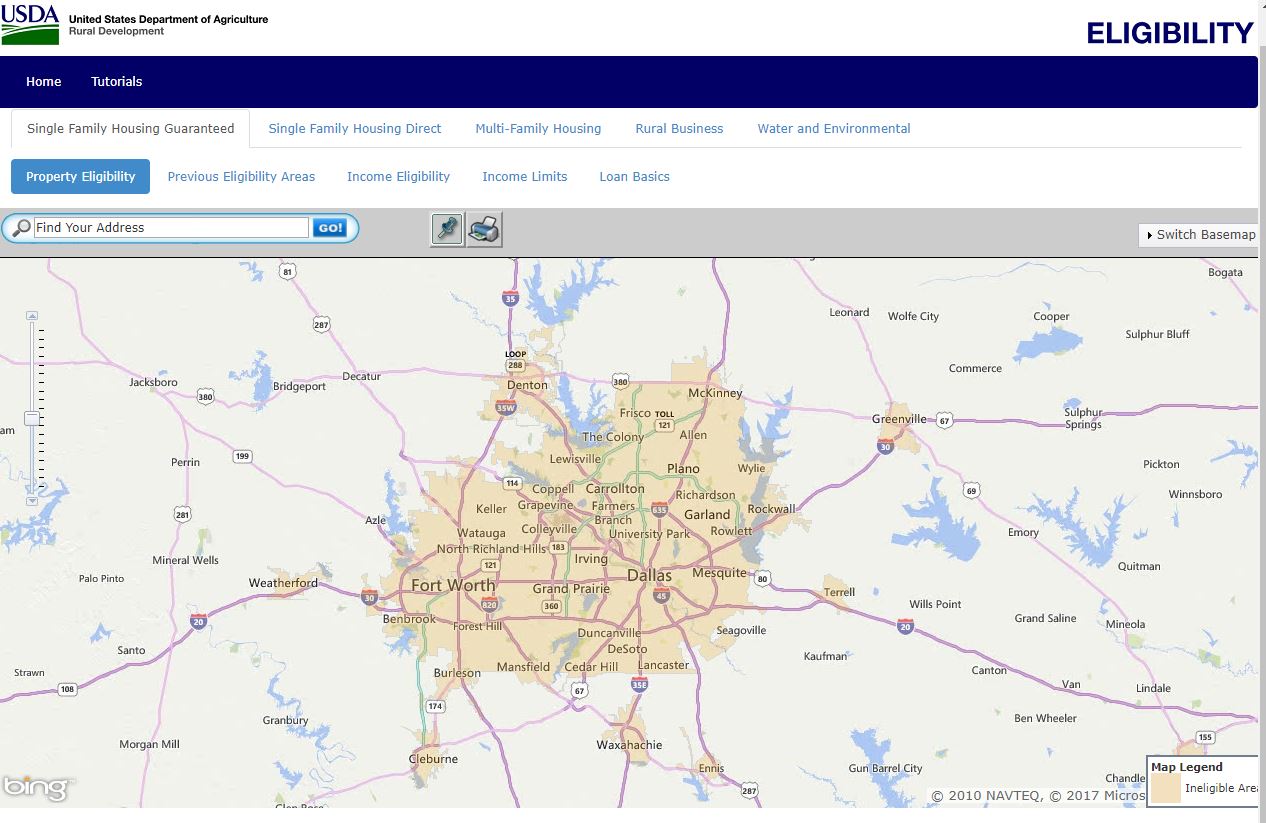

My Branch Closes FHA / VA & USDA Loans at 580+ in Texas, Oklahoma & Louisiana

Gold Financial Services is a Division of Amcap Mortgage, Ltd. NMLS #129122. Equal Housing Lender

J. Scott Harris is a Nationally Recognized Mortgage & Social Media Authority.

Relaxing FHA Condo rules & expanding FNMA Debt Ratios are 2 new enhancements to help 1st time buyers

Relaxing FHA Condo rules & expanding FNMA Debt Ratios are 2 new enhancements to help 1st time buyers