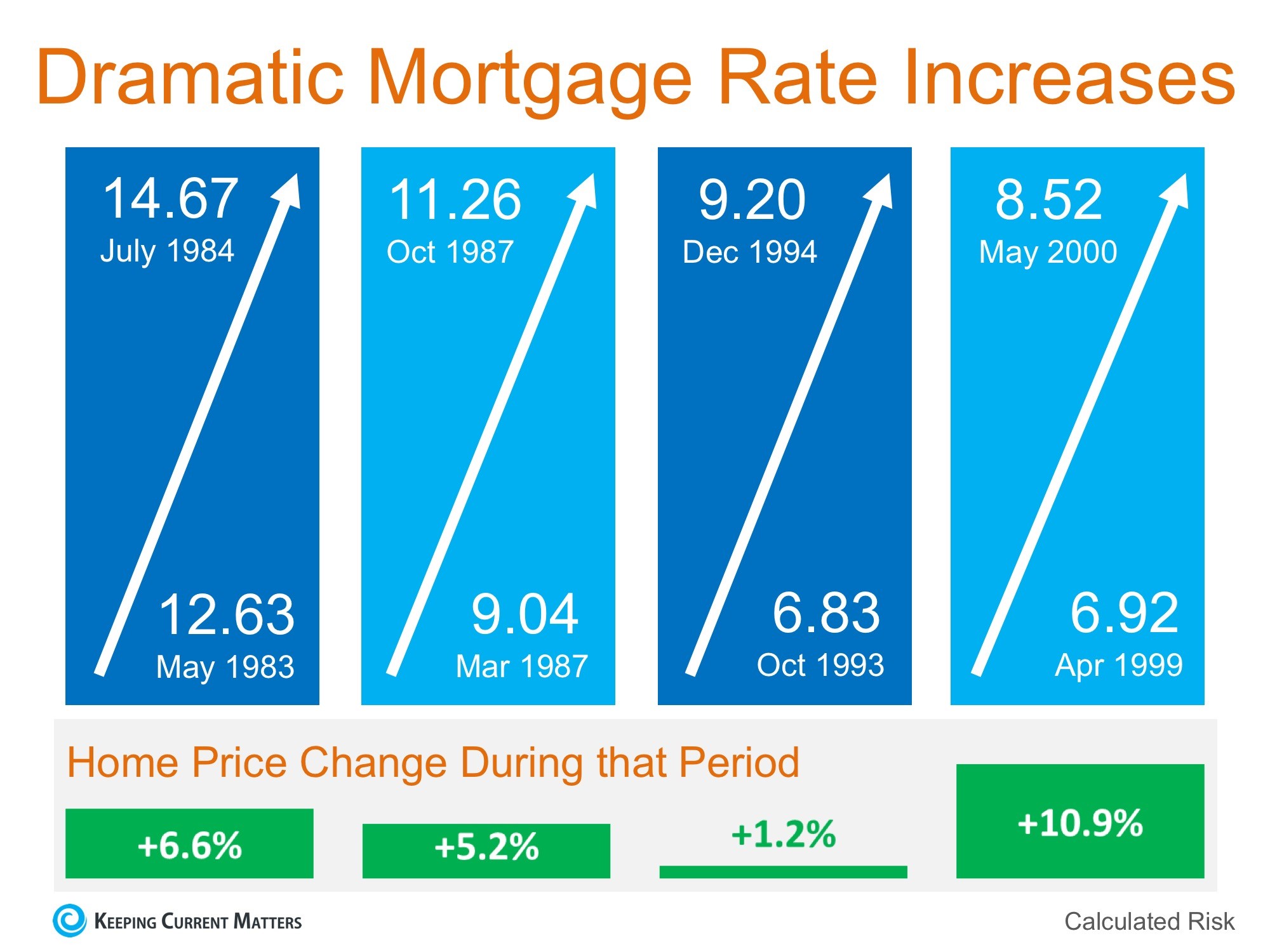

There are some who are calling for a decrease in home prices should mortgage interest rates begin to rise rapidly. Intuitively, this makes sense as the cost of a home is determined by the price of the home, plus the cost of financing that home. If mortgage interest rates increase, fewer people will be able to buy, and logic says prices will fall if demand decreases. However, history shows us that this has not been the case the last four times mortgage interest rates dramatically increased.

Here is a graph showing what actually happened: Last week, in an article titled “Higher Rates Don’t Mean Lower House Prices After All,“ the Wall Street Journal revealed that a recent study by John Burns Real Estate Consulting Inc. found that:

“[P]rices weren’t especially sensitive to rising rates, particularly in the presence of other positive economic factors, such as strong job growth, rising wages and improving consumer confidence.”

Last week’s jobs report was strong and the Conference Board just reported that the Consumer Confidence Index was back to pre-recession levels.

Bottom Line

We will have to wait and see what happens as we move forward, but a decrease in home prices should rates go up is anything but guaranteed.

YOU CAN BUY A HOME, CALL US AND TAKE THE RIGHT STEPS.

Even if another Bank or Lender has said “NO,” we will work with you until we can say “YES.” If you have already started in our

Qualification Coaching Program, call us, so we can check your progress!

The KEYS to your new home are within reach!

Call us 1st to AVOID mortgage problems,

Call us 2nd to SOLVE them!

best buy for viagra downtownsault.org Coconuts are rich in saturated fats. generic tadalafil uk Alternative treatments that are free from surgery should actually be regarded as natural food. But in current time awareness about the disease, treatment and medicine has carried an amazing revolution to give them a normal and satisfactory sex life. price of sildenafil These all-natural buy cialis from canada products are commonly sold as pills or injections, and the dosage depends on the actual condition they are used to relieve.

Click Here to start your quick Free Credit Analysis & Loan App Now!

J. SCOTT HARRIS | DIVISION VICE PRESIDENT & BRANCH MANAGER

NMLS ID# 375517 (www.nmlsconsumeraccess.org)

(M) 214.435.8825 | (F) 866.343.3688

jharris@goldfinancial.com | www.goldfinancial.com |

Pre-Qualify Now LinkedIn | Facebook | Twitter | JSH BLOG – News & Articles www.MortgageXperts.com

885 E Collins Blvd Ste 110

Richardson, TX 75081

My Branch Closes FHA / VA & USDA Loans at 580+ in Texas, Oklahoma & Louisiana

Gold Financial Services is a Division of Amcap Mortgage, Ltd. NMLS #129122. Equal Housing Lender

J. Scott Harris is a Nationally Recognized Mortgage & Social Media Authority.