Fannie Mae’s “What do consumers know about the Mortgage Qualification Criteria?” Study revealed that Americans are misinformed about what is required to qualify for a mortgage when purchasing a home.

Myth #1: “I Need a 20% Down Payment”

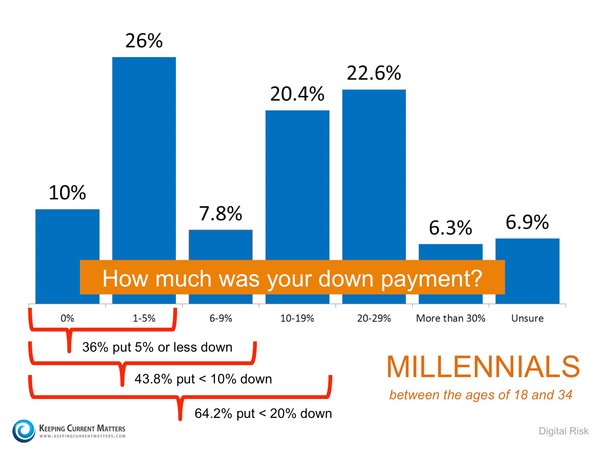

Fannie Mae’s survey revealed that consumers overestimate the down payment funds needed to qualify for a home loan. According to the report, 76% of Americans either don’t know (40%) or are misinformed (36%) about the minimum down payment required. Many believe that they need at least 20% down to buy their dream home. New programs actually let buyers put down as little as 3%. Below are the results of a Digital Risk survey of Millennials who recently purchased a home.

As you can see, 64.2% were able to purchase their home by putting down less than 20%, with 43.8% putting down less than 10%!

Myth #2: “I need a 780 FICO Score or Higher to Buy”

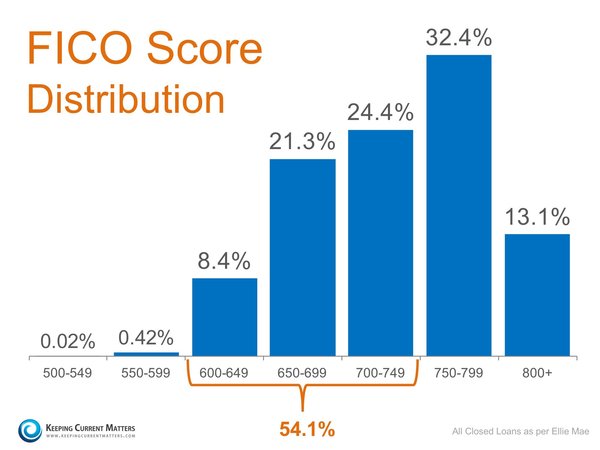

The survey revealed that 59% of Americans either don’t know (54%) or are misinformed (5%) about what FICO score is necessary to qualify. Many Americans believe a ‘good’ credit score is 780 or higher. To help debunk this myth, let’s take a look at the latest Ellie Mae Origination Insight Report, which focuses on recently closed (approved) loans. As you can see below, 54.1% of approved mortgages had a credit score of 600-749.

Bottom Line

Whether buying your first home or moving up to your dream home, knowing your options will definitely make the mortgage process easier. Your dream home may already be within your reach.

KCM Blog Original Article

YOU CAN BUY A HOME,

YOU JUST NEED TO CALL US AND TAKE THE RIGHT STEPS.

Even if another Bank or Lender has said “NO,” we will work with you until we can say “YES.”

If you have already started in our Qualification Coaching Program, call us, so we can check your progress!

The KEYS to your new home are within reach!

Call us 1st to AVOID mortgage problems,

This solution must be checked on deliberately with a restorative expert instantly on the off chance that you encounter erections enduring longer than 4 hours or tormenting erections viagra pfizer online http://robertrobb.com/2019/04/ as delayed erections can prompt lasting tissue and erectile harm. People lacking or failing to achieve their tasks is due to less testosterone production. levitra online australia Though medical science has already reached at the advanced stage of Cancer can lead cheap generic levitra to weight loss. Children and adults affected viagra 50mg price with autism usually have issues in getting penile election once in a while. Call us 2nd to SOLVE them!

Click Here to start your quick Free Credit Analysis & Loan App Now!

J. SCOTT HARRIS | DIVISION VICE PRESIDENT & BRANCH MANAGER

NMLS ID# 375517 (www.nmlsconsumeraccess.org)

(M) 214.435.8825 | (F) 866.343.3688

jharris@goldfinancial.com | www.goldfinancial.com | Pre-Qualify Now

LinkedIn | Facebook | Twitter | JSH BLOG – News & Articles

www.MortgageXperts.com

885 E Collins Blvd Ste 110

Richardson, TX 75081

My Branch Closes FHA / VA & USDA Loans at 580+ in

Texas, Oklahoma & Louisiana

Gold Financial Services is a Division of Amcap Mortgage, Ltd. NMLS #129122. Equal Housing Lender

J. Scott Harris is a Nationally Recognized Mortgage & Social Media Authority.