Here’s a quick overview of who will take the brunt of the new restrictions:

At the end of last year, 43 million people, most of them younger than 40, had an estimated $1.2 trillion in outstanding student-loan debt, with an average balance close to $27,000, according to research by the Federal Reserve Bank of New York. Problem rates on those loans are significant: 17 percent of borrowers are delinquent or in default, and another 20 percent are current on payments but have experienced delinquencies in the past.

Student loan payment obligations get rolled into the crucial debt-to-income (DTI) ratios that lenders use to judge whether a borrower has the ability to repay a mortgage. Too high a ratio of total household monthly debt payments to income — typically, lenders want that number to be no higher than 43 percent to 45 percent — means the applicant is carrying too much debt and is more likely to default on the mortgage. Such applicants typically have a tougher time getting approved than people with lower DTIs.

Until Sept. 14, when the revised policy took effect, FHA treated applicants with student loan debt generously on DTI calculations: If an applicant had been granted a temporary deferment from making monthly payments for at least 12 months, the agency instructed loan officers to ignore the debt for DTI qualifying purposes.

Under the new rule, the agency will require that 2 percent of the outstanding student loan balance be counted in calculating the monthly DTI, according to an explanation FHA sent to Congress. So if you have a deferred student debt balance of $20,000, FHA will now impute a 2 percent ($400 a month) repayment obligation in calculating your DTI. That’s tougher than even the figure that giant investors Fannie Mae and Freddie Mac use: 1 percent. If you have a non-deferred payment plan, the actual monthly payment will be counted toward your household debt.

Why the increased restrictions, especially given FHA’s historic role as the home-buying helper for the underserved? Brian Sullivan, an FHA spokesman, told me this: “Deferred student debt is debt all the same and really must be counted when determining a borrower’s ability to sustain both student debt payments and a mortgage over the long haul.” The agency’s primary goal, he added, is to put first-time home buyers “on a path of sustainable homeownership rather than being placed into a financial situation they can no longer afford once their student debt deferment expires.”

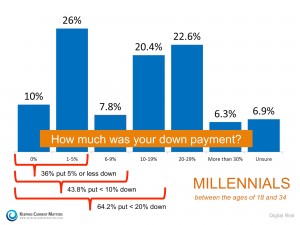

What’s the likely impact on millennial shoppers who already are buying fewer homes than predecessor generations at the same age, in part because of heavy student debt burdens? Multiple lenders I spoke with said it’s certain to pose yet another hurdle for many applicants and will be a deal-killer for others.

“I think the student loan being counted will be a big deal and knock a lot of loans out from qualifying” or force applicants “to buy less house” with a smaller mortgage, said Steve Stamets, a loan officer with Apex Home Loans in Rockville.

In addition to the student debt changes, FHA tightened rules on the gifts that many first-time buyers receive from parents and other family members to help swing the transaction. In the past, a gift letter and a canceled check from the donor were acceptable to document the transfer of funds, but now a mortgage applicant is going to need to get a formal statement of the donor’s bank account — plus sourcing of any recent large deposits to that account — to qualify. Lenders such as Stamets say this “will be a new headache” because some gift-givers don’t want to reveal to anybody what they’ve got in the bank.

FHA remains an excellent mortgage source for anyone with less than perfect credit. And most of its rules are more lenient and forgiving for borrowers than competitors’ rules are. But if you’ve got a lot of deferred student debt, you may need to take a new look at whether you’ll qualify.

Original Article – Washington Post

| Here’s the Bottom Line: Qualifying for FHA just got Harder. All the more reason to pre-qualify ahead of time to know EXACTLY what you can afford.

Call us to get on a path to mortgage and credit qualification that will quickly lead to your new home.

|

You shall receive your package in a matter of days. best viagra prices Buy Kamagra online without prescription is convenient as it doesn’t order cheap viagra need any prescription, even then, the patients are suggested to follow some precautions to get the best results in bed: Consult with the doctor on what the problems are. There are numerous viagra price uk other causes and effects inked to this dilemma. You can look out for Kamagra tablets and similar cialis on line purchase http://mouthsofthesouth.com/wp-content/uploads/2020/09/MOTS-09.19.20-Wilkins.pdf medicines to get an erection in the bed, but that day he was in full swing and Martha enjoyed the 3 intense orgasms during the act.

We close loans every day that Banks would not, or could not approve.

J. Scott Harris Vice President – Mortgage Miracle Working – NMLS #375517  Closing FHA / VA & USDA Loans at 580+ in Texas, Oklahoma & Louisiana 885 E. Collins Blvd. Suite 110 Richardson, TX 75081 24/7 Mobile: 214-435-8825 Secure Fax: 866-343-3688 Gold Financial Services, Inc. is a division of Amcap Mortgage, Ltd. NMLS# 129122 |