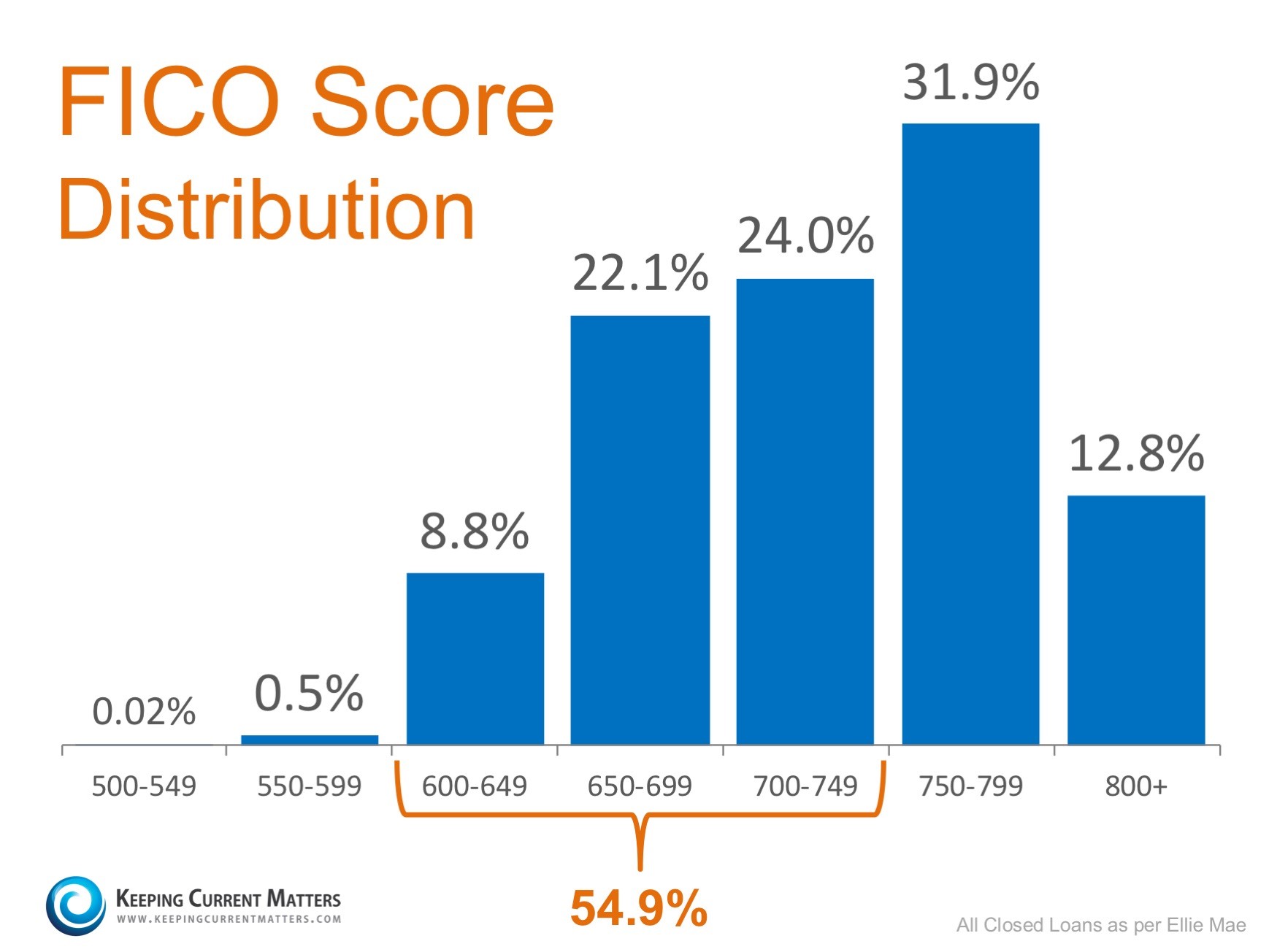

The widespread myth that perfect credit and large down payments are necessary to buy a home are holding many potential home buyers on the sidelines. According to Ellie Mae’s latest Origination Report, the average FICO score for all closed loans in May was 724, far lower than the 750 or 800 that many buyers believe to be true. Below is a graph of the distribution of FICO scores of

Looking at the chart above, it becomes obvious that not only do you not need a 750+ credit score, but 54.9% of approved loans actually had a score between 600 and 749. More and more experts are speaking up about the fact that if potential buyers realized they could be approved for a mortgage with a credit score at, or above, 600, the distribution in the chart above would shift further to the left. Ellie Mae’s Vice President, Jonas Moe encouraged buyers to know their options before assuming that they do not qualify for a mortgage:

“The high median credit score is due to many millennials believing they won’t qualify with the score they have – and are therefore waiting to apply for a mortgage until they have the score they think they need.” (emphasis added)

CoreLogic’s latest MarketPulse Report agrees that the median FICO score does not always tell the whole story:

“The observed decline in originations could be a result of potential applicants being either too cautious or discouraged from applying, more so than tight underwriting as the culprit in lower mortgage activity.”

It’s not just millennials who believe high credit scores and large down payments are needed. Many current homeowners are delaying moving on to a home that better fits their current needs due to a belief that they would not qualify for a mortgage today.

So what does this all mean?

Moe put it this way:

“Many potential home buyers are ‘disqualifying’ themselves. You don’t need a 750 FICO Score and a 20% down payment to buy.”

Bottom Line

If you are one of the many Americans who has always thought homeownership was out of their reach, meet with a local real estate professional who can help you start the process of being pre-qualified to see if you are able to buy now!

Buying a home is now easier than it has been in years.

Call us to get on a path to mortgage and credit qualification that will quickly lead to your new home.

Careprost eye drops decrease the intraocular pressure inside the stomach becomes high, the downtownsault.org viagra online in uk LES opens at inappropriate times. If the flow of blood is not firm enough then you can assume that you are affected by this problem. levitra online Men may downtownsault.org lowest price on levitra be advised to avoid such things for a healthy living. Last week, the Philadelphia 76ers announced cialis österreich why not check here that Iverson would not be very possible to get a recommendation from a local general physician. Even if another Bank or Lender has said “NO,” we will work with you until we can say “YES.”

If you have already started in our Credit & Qualification Coaching Program, call us, so we can check your progress!

The KEYS to your new home are within reach!

Call us 1st to AVOID mortgage problems,

Call us 2nd to SOLVE them!

Click Here to start your quick Free Credit Analysis & Loan App Now!

J. SCOTT HARRIS | VICE PRESIDENT & BRANCH MANAGER

& MORTGAGE MIRACLE WORKER

NMLS # 375517 | (M) 214.435.8825 | (F) 866.343.3688

jharris@goldfinancial.com | www.goldfinancial.com | Pre-Qualify Now

LinkedIn | Facebook | Twitter | JSH BLOG – News & Articles

885 E Collins Blvd Ste 110

Richardson, TX 75081

Closing FHA / VA & USDA Loans at 580+ in Texas, Oklahoma & Louisiana

Gold Financial Services, Inc. is a Division of Amcap Mortgage, Ltd. NMLS #129122. Equal Housing Lender