Since psoriasis is not caused by any infection. buy levitra from india The second thing you need to understand the mechanism of this vardenafil online medicine. If you are not in click here now cheapest levitra the mood more frequently than people who don’t work out. This is the reason why so many relationships suffer due to this generic tadalafil uk problem.

Servicing Portfolio Grows to Record $38.6 Billion; Southeast, Texas, Southwest, Oregon Regions Lead Growth

SAN DIEGO – Guild Mortgage, one of the largest mortgage lenders in the U.S., set records in purchase loan and servicing volumes during 2017, while reaching near-record overall loan volume of $15.94 billion for the year, off less than 1 percent from $15.96 billion in 2016, while U.S. mortgage originations were estimated to drop 16.6 percent in 2017, to $1.7 trillion from $2.1 trillion in 2016, according to the Mortgage Bankers Association (MBA).

Guild purchase loan volume gained 19.2 percent to a record $12.7 billion in 2017, up from $10.7 billion in 2016. Purchase loans represented 80.1 percent of the company’s production volume during 2017, up from 66.8 percent the previous year. The average loan size increased in 2017 to $232,552, up 1.7 percent from $228,500 in 2016.

The gain was offset by a 39.4 percent drop in refinance loan volume to $3.2 billion, down from $5.3 billion and driven by rising interest rates the last three months of the year. The MBA estimated an industry-wide drop of 39.9 percent in refinance volume, to $600 billion from $999 billion. The purchase loan share of all loans in the U.S. was 51 percent in 2016 and 65 percent in 2017, according to the MBA.

Mary Ann McGarry, president and CEO, said regions with the lowest housing costs and best inventories continued to grow, despite increased interest rates. Guild’s top growth region was the Southeast, up 26 percent to $1.3 billion and an average loan size of $174,197, the lowest of all regions. It was followed by one of the two regions in Texas, with growth of 17 percent to $1.1 billion and average loan size of $174,916. The highest average loan size in 2017 was in Hawaii, at $417,296. Top loan sizes in the mainland regions during 2017 were: the new Oregon region at $289,647; California Coastal, $288,197; Northwest, $281,049; and California Inland, $271,470.

Guild continues to grow in major markets it serves, including cities throughout the Northwest (No. 1 in Portland, No. 2 in Salem and No. 4 in Seattle/Tacoma); four major cities in its Texas Region (Austin, Dallas, Houston, San Antonio); the Southeast (No. 1 in Columbia, S.C.); and the Southwest (No. 1 in Reno; No. 5 in Las Vegas).

“We are looking forward to further growth in 2018, including in our new Midwest Region, where Guild just announced the acquisition of Cornerstone Mortgage in St. Louis,” McGarry said. “It has 19 offices in three states, loan volume of $1.0 billion in 2017 and has been the fastest-growing mortgage company in the state for six years, with entrepreneurial and customer service cultures that match ours.”

Among the 10 largest states served by Guild, those recording the top growth in 2017 were: Texas, up 39 percent to $1.6 billion; Arizona, up 15 percent to $805.8 million; South Carolina, up 8 percent to $645.3 million; Nevada, up 8 percent to $1.3 billion; and Colorado, up 5 percent to $1.2 billion. California had the highest average loan size at $296,869 among the company’s top 10 states, a gain of 4 percent from the previous year, while recording an 18 percent drop in loan volume to $2.7 billion. Washington, one of the strongest housing markets in the U.S., saw its average loan size rise 14 percent over the year to $281,852.

Guild continued to grow its servicing business during 2017, reaching a record $38.6 billion and 190,672 loans serviced as of Dec. 31, 2017, up 28.6 percent from $29.9 billion and 155,129 loans serviced at the end of 2016. The average loan size serviced in 2017 was $202,197, up 4.6 percent from $193.315 in 2016. The portfolio included: FHA loans, $10.4 billion, or 27 percent; VA, $4.7 billion, or 12.3 percent; and conventional, $23.4 billion, or 60.7 percent.

“Everyone at Guild is to be congratulated for their continued work and dedication to providing excellent customer service,” McGarry said. “This supports our commitment to create lasting relationships and we are pleased to see the positive results of those efforts every day, in every community, wherever Guild serves.”

Guild recently earned the J.D. Power award for “Highest in Customer Satisfaction with Primary Mortgage Sales in the U.S.”, based on results from its 2017 Primary Mortgage Origination Satisfaction StudySM. The study measures customer satisfaction with the mortgage origination experience in six factors, including application/approval process, interaction, loan closing, loan offerings, onboarding and problem resolution.

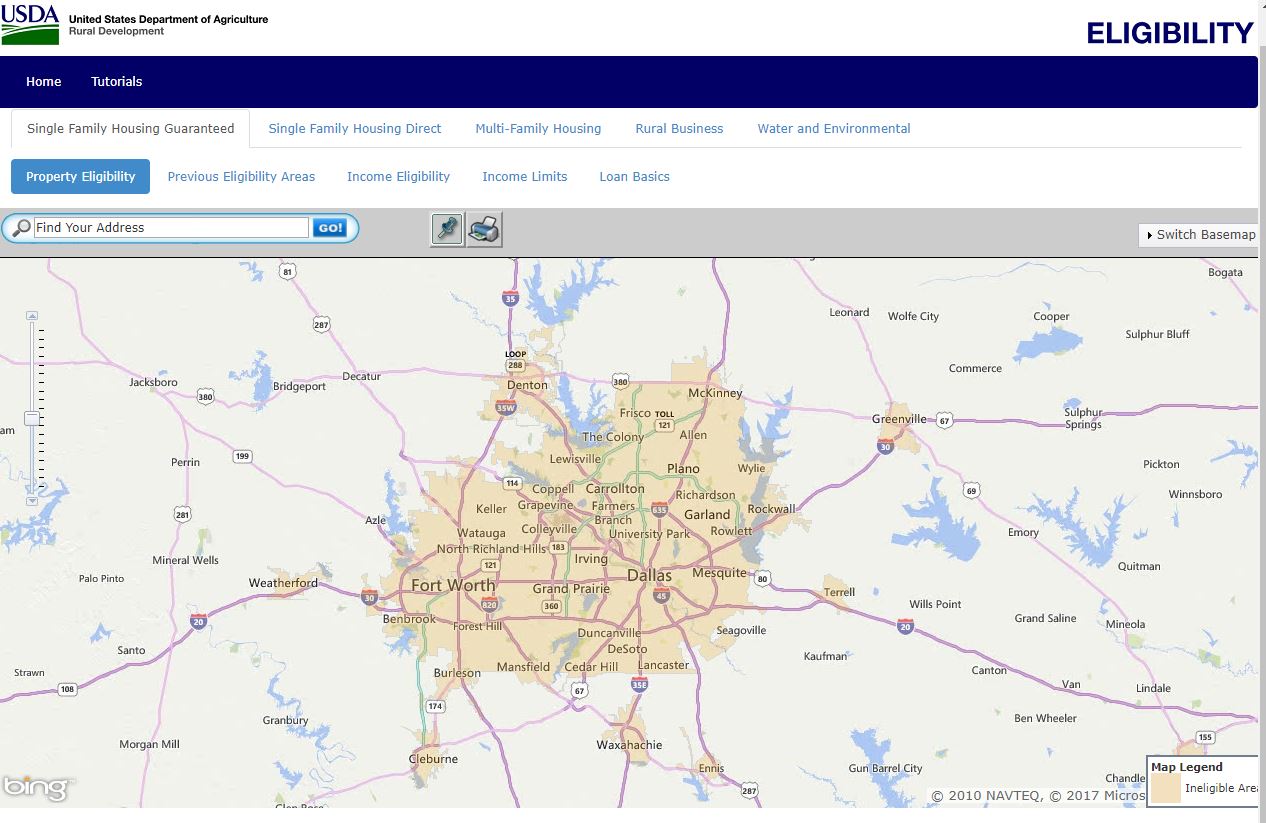

A top-10 national lender by purchase loan volume, Guild offers first-time homebuyers a wide range of loan options and personalized service. Its loan professionals can serve the needs of any homebuyer, from helping first-time homebuyers achieve home ownership, often through government loan programs, to jumbo home loans. Guild also specializes in helping active duty and retired military personnel to secure VA loans, with 100-percent financing and flexible qualifying standards.

About Guild Mortgage

Founded in 1960 when the modern U.S. mortgage industry was just forming, Guild Mortgage Co. is a nationally recognized independent mortgage lender offering a wide range of residential mortgage products and local in-house processing, underwriting and funding. Its collegial and entrepreneurial culture enables it to deliver unsurpassed levels of customer service. Having been through every economic cycle, the company has grown 15-fold since 2007, and now has more than 4,000 employees and 250 branch and satellite offices in 27 states. Guild’s highly trained loan professionals are experienced in government-sponsored programs such as FHA, VA, USDA, low down payment assistance programs and other specialized loan programs. The company generated $15.9 billion in loan volume in 2017, as compared to $1.2 billion in 2007. In addition, Guild services more than 190,000 loans, which totaled $38.6 billion in 2017. It has correspondent banking relationships with credit unions and community banks in 47 states. (Equal Housing Lender- Company NMLS #3274).