You don’t have to do them all, of course, but accomplishing just a few could make a big difference in your life a year from now. The most important step, as always, is to get started.

1. Increase your 401(k) contribution.

This is probably the single easiest and most painless way to ensure that you’ll be richer a year from now. You probably won’t miss it! You can increase your 401(k) contribution by 1%, 2%, 5% or whatever amount you feel comfortable with. Since it will be payroll deducted, it will require no further action on your part. And since the contribution is tax-deductible, at least part of the amount will effectively be paid by the government. For example, a 3% contribution may have been net effect of a 2% reduction in your net pay, after accounting for the tax benefit. (Most 401k plans allow employees to withdraw without penalty for the purchase of a home. Many of our 1st time buyers get a gift from family or withdraw funds from their 401k – JSH)

2. Start a non-retirement payroll savings plan.

If you are already maxed out on your 401(k) contributions, or if your employer doesn’t offer a 401(k) plan, you can start a non-retirement payroll savings plan. Just like a 401(k) plan, the money is deducted from your pay, and put into a savings vehicle of your choice. This can be a savings account, money market fund, a mutual fund or brokerage account. It will allow you to save money on an automatic basis. And just as is the case with a 401(k), the money will come out with virtually no action required on your part, and it will be hardly noticeable once you get used to it.

3. Pick 3 expenses to eliminate.

Reducing or eliminating expenses is one of the best ways to improve your financial situation. Pick three expenses that you are currently paying on a regular basis, and get rid of them. Naturally, these need to be non-essential expenses. You can take a look at any kind of premium services that you have, including your cable TV package, or even your cellphone package. You can also consider an unused gym membership, magazine subscriptions, or even a home security system if you live in a relatively safe area.

4. Leave your credit cards at home.

If you normally shop with a wallet full of credit cards, the time is now to adopt a strategy in which your credit cards are removed from your wallet, and only pulled out for true emergency situations. When you are paying with cash, or the money is being direct debited out of your checking account, it puts limits on how much you spend. Conversely, since credit cards afford the wiggle room of a credit line, you’ll be tempted to spend more money than you actually have. Try leaving your credit cards home when you go shopping, for at least the next few weeks, and see if it doesn’t help you to reduce your spending. You could even see the added benefit of increasing your credit scores as a result of lower credit card balances relative to your credit card limits – that’s a major factor in your credit scores called credit utilization. Try to keep your credit Balance to Limit Ratio below 30% – JSH

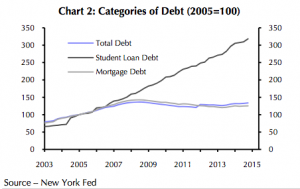

5. Don’t take on any new debt.

Everyone who is in debt wants to get out of it. But step number one in getting out of debt is not taking on any new debt. It will do little good to have plan to payoff your debts, while you are continuing to incur new ones. And if you might be unable to commit to a debt payoff strategy, simply avoiding new debt and making your minimum monthly payments will eventually get you out of debt. Even revolving credit lines require that you pay a certain amount of principal each month. Eventually, all of your debts will be paid as long as you avoid taking on new debt. This is probably the single easiest way to get out of debt, at least eventually.

6. Start that debt snowball. (Dave Ramsey method – Buy his books!)

Far more powerful than simply not taking on any new debt, is combining that strategy with a concentrated debt payoff effort. Make this year the year you finally start a snowball, and get out of debt once and for all. With a debt snowball, you start by paying off your smallest debt first. Once you do that, you move up to paying the next smallest debt, and so on. Paying off the smallest debt not only empowers to take on the next debt, but it also improves your cash flow because the payment on the smallest debt no longer exists. And as each debt is paid, your cash flow improves a little more, making it easier to go after the next card or debt.

7. Use a 0% balance transfer credit card.

There are plenty of credit cards out there that offer zero-interest balance transfers. If you have a substantial amount of credit card debt, this can mean big savings. Let’s say that you owe $10,000 in credit card debt at an average interest rate of 15%; that means that you will pay $1,500 in interest over the next 12 months. If you transfer the balance to a 0% credit card, you will be $1,500 richer one year from now. Most zero-interest transfers run from 12 to 18 months, which will guarantee you at least one year without interest. If you can combine a 0% balance transfer with the debt snowball, you’ll get out of debt that much faster. You can figure out a credit card payoff timeline using free calculators like this one.

8. Cut your living expenses 10% across the board.

Cutting out certain expenses entirely can be difficult, and in some cases impossible. As an alternate strategy, you can simply make an across the board cut in your spending, averaging say 10%. I say “averaging” because some expenses can’t be reduced, such as your mortgage payment. But there are many other ways to save including: food, entertainment, utilities, and even gasoline, repairs, and insurance can often be cut by much more than 10%.

9. Save 10% of your income each month.

If you are successful in cutting your living expenses by 10%, you should plan to direct that money into savings. The purpose of cutting expenses is not to go on a financial diet, but to free up capital for future growth and financial independence. You can start out directing the extra money into a savings account, and then eventually move into mutual funds, or an investment brokerage account where you can diversify into many different assets. Cuts in your living expenses may not feel good, but the growth in your savings and investments will more than offset that.

10. Sell or donate everything you no longer use or need.

One of the best ways to raise cash is by selling anything and everything you have that you no longer use or have a need for. You can often sell these items for hundreds or even thousands of dollars. The money sitting in that stuff will look a lot better sitting in a bank account or mutual fund. Craigslist and Ebay are easy ways to turn clutter into cash! If you have items that you don’t think you can sell, look into donating them to a charity. The value of the item will be tax deductible, and provide you with at least some extra money when you file your income taxes.

11. Consider raising the deductibles on your insurance policies.

If you are increasing your savings using any of the above strategies, you’ll be in a better position to increase deductibles on your insurance policies. This includes your home insurance, auto insurance, and even your medical insurance. This can save you hundreds or even thousands of dollars each year, which will be even more money that you can put into savings and investments. Understand that one of the benefits of greater savings is the ability to increase deductibles. Since you will have the money to cover the deductibles, you’ll be able to “afford” to set them higher. And if you never have to make a claim, you’ll be that much richer.

12. Go vacation-less this year.

This is not a fun idea, but it is also one of the very best ways to improve your financial situation. No one ever becomes richer without some form of self-sacrifice. The advantage of skipping your vacation is that it will only hurt for the week that you would be away. The rest of your year would be virtually unaffected Plan stay close to home, and enjoy the simple pleasures of life that will help to rechargeable your battery in the same way that a full-blown vacation to a remote resort would. And if any of these strategies make you feel at all uncomfortable, just think about how much better you’ll feel when you are living in your new home!

Here’s the Bottom Line: With a little work, you new home is within reach! FANNIE MAE HAS A NEW 3% DOWN PROGRAM THAT ALLOWS GIFT FUNDS FHA IS 3.5% DOWN AND ALSO ALLOWS GIFTS FUNDS VA AND USDA ARE 100% FINANCING – NO DOWN PAYMENT Call us 1st to AVOID mortgage problems, Call us 2nd to SOLVE them! We close loans every day that Banks would not, or could not approve.

Mortgage Expert J. Scott Harris Vice President – Mortgage Miracle Working NMLS #375517 Gold Financial Services, Inc. Closing FHA / VA & USDA Loans at 580+ in Texas, Oklahoma & Louisiana 885 E. Collins Blvd. Suite 110 Richardson, TX 75081 24/7 Mobile: 214-435-8825 Secure Fax: 866-343-3688 |

Gold Financial Services, Inc. is a division of Amcap Mortgage, Ltd. NMLS# 129122