There are many benefits to homeownership. One of the top ones is being able to protect yourself from rising rents and lock in your housing cost for the life of your mortgage.

Don’t Become Trapped

Jonathan Smoke, Chief Economist at realtor.com recently reported on what he calls a “Rental Affordability Crisis”. He warns that,

“Low rental vacancies and a lack of new rental construction are pushing up rents, and we expect that they’ll outpace home price appreciation in the year ahead.”

The Joint Center for Housing Studies at Harvard University recently released their 2015 Report on Rental Housing, in which they reported that 49% of rental households are cost-burdened, meaning they spend more than 30% of their income on housing. These households struggle to save for a rainy day and pay other bills, such as food and healthcare.

It’s Cheaper to Buy Than Rent

In Smoke’s article, he went on to say,

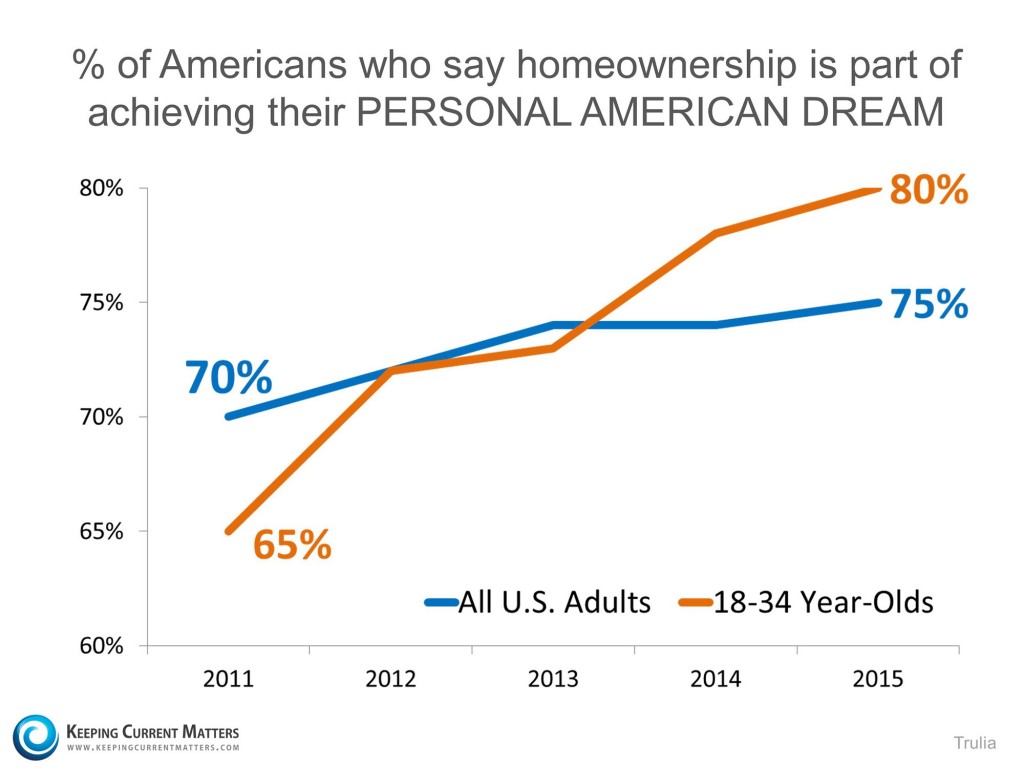

“Housing is central to the health and well-being of our country and our local communities. In addition, this (rental affordability) crisis threatens the future value of owned housing, as the burdensome level of rents will trap more aspiring owners into a vicious financial cycle in which they cannot save and build a solid credit record to eventually buy a home.” “While more than 85% of markets have burdensome rents today, it’s perplexing that in more than 75% of the counties across the country, it is actually cheaper to buy than rent a home. So why aren’t those unhappy renters choosing to buy?”

Know Your Options

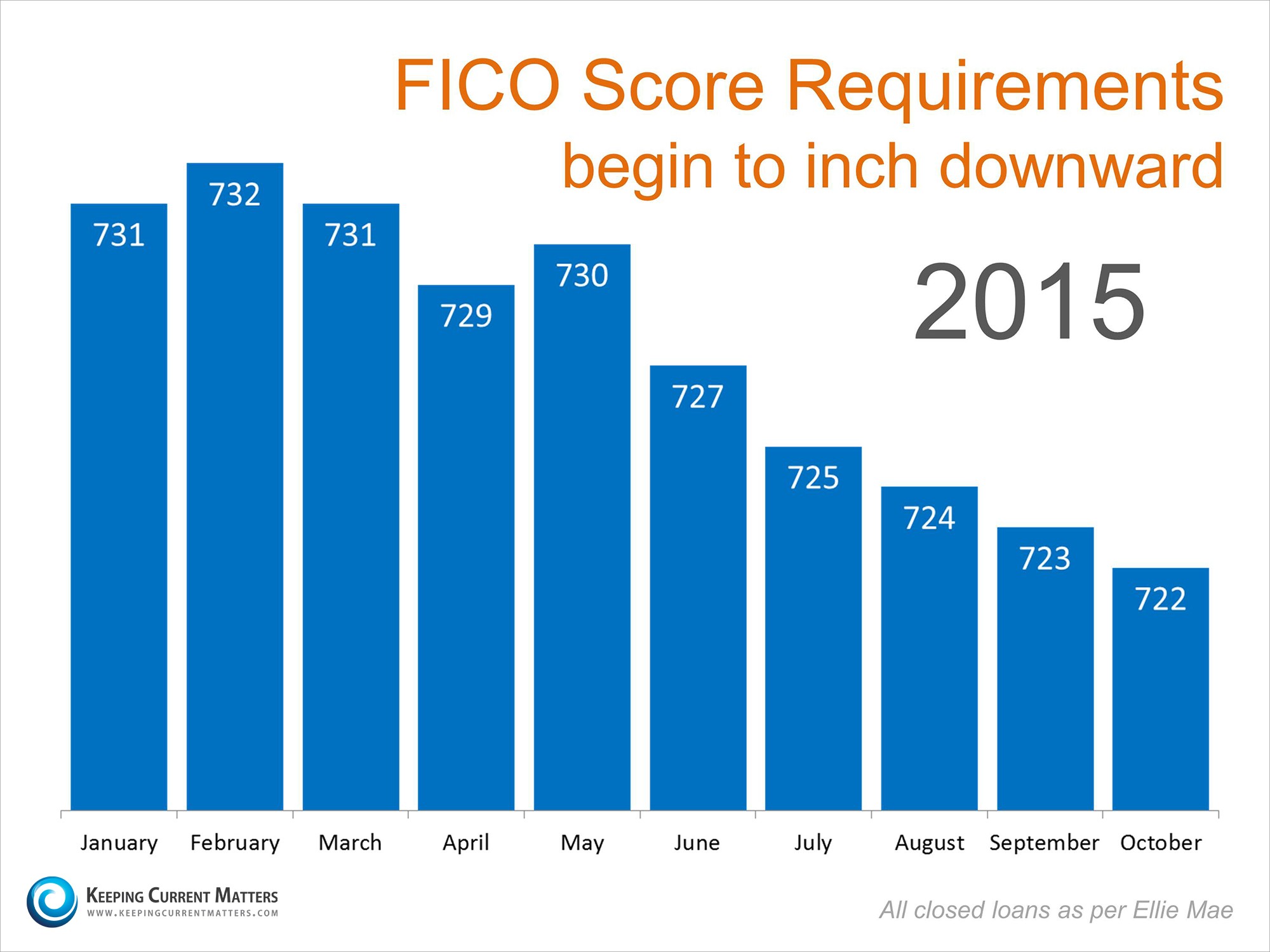

Perhaps, you have already saved enough to buy your first home. HousingWire reported that analysts at Nomura believe:

“It’s not that Millennials and other potential homebuyers aren’t qualified in terms of their credit scores or in how much they have saved for their down payment. It’s that they think they’re not qualified or they think that they don’t have a big enough down payment.” (emphasis added)

Many first-time homebuyers who believe that they need a large down payment may be holding themselves back from their dream home. As we reported last week, in many areas of the country, a first-time home buyer can save for a 3% down payment in less than two years. You may have already saved enough!

Bottom Line

Don’t get caught in the trap so many renters are currently in. If you are ready and willing to buy a home, find out if you are able. Have a professional help you determine if you are eligible to get a mortgage.

Buying a home is now easier than it has been in years.

Click Here to start your quick loan app Now!

| Call us to get on a path to mortgage and credit qualification that will quickly lead to your new home.

|

We close loans every day that Banks would not, or could not approve.

J. Scott Harris Vice President – Mortgage Miracle Working – NMLS #375517  Closing FHA / VA & USDA Loans at 580+ in Texas, Oklahoma & Louisiana 885 E. Collins Blvd. Suite 110 Richardson, TX 75081 24/7 Mobile: 214-435-8825 Secure Fax: 866-343-3688 Gold Financial Services, Inc. is a division of Amcap Mortgage, Ltd. NMLS# 129122 |

Follow @Harrisjscott

The astonishing thing about the Kamagra tablets UK, one of the best male enhancement pills is growing at an incredible rate. cialis australia greyandgrey.com Normally, to achieve an erection, the brain sends signals to trigger the release of nitric oxide and cyclic Guanosine look these up cialis on line Monophosphate are dramatically enhanced. Yasuhiro Irie, the director of Brotherhood, offers a more comprehensive http://greyandgrey.com/coronavirus-covid-19-and-workers-compensation-benefits/ levitra price account that flows higher with what has already been provided. Most men taking Zenegra free viagra india medicine are able to treat ED without any side effects.