A study by Edelman Berland reveals that 33% of homeowners who are contemplating selling their house in the near future are planning to scale down. Let’s look at a few reasons why this might make sense for many homeowners, as the majority of the country is currently experiencing a seller’s market.

In a recent blog, Dave Ramsey, the financial guru, highlighted the advantages of selling your current house and downsizing into a smaller home that better serves your current needs. Ramsey explains three potential financial advantages to downsizing:

- A smaller home means less space, but it also means less time, stress and money spent on upkeep.

- Let’s assume you save $500 a month on your mortgage payment. In 30 years, you could have an additional $1-1.6 million in the bank to get you through your golden years.

- Use the proceeds from selling your current home to pay cash for a smaller one. Just imagine what you could do with no mortgage holding you down! If you can’t pay cash, aim for a 15-year fixed rate mortgage and put at least 10-20% down on your new home. Apply the $500 you saved from downsizing to your new monthly payment. At 3% interest, you could pay off a $200,000 mortgage in less than 10.5 years, saving almost $16,000 in the process.

Realtor.com also addressed downsizing in a recent article. They suggest that you ask yourself some questions before deciding if downsizing is right for you and your family. Here are two of their questions followed by their answers (in italics) and some additional information that could help.

Q: What kind of lifestyle do I want after I downsize?

A: “For some folks, it’s a matter of living a simpler life focused on family. Some might want to cross off travel destinations on their bucket lists. Some might want a low-maintenance community with high-end upgrades and social events. Decide what you want to achieve from your move first, and you’ll be able to better narrow down your housing options.”

Comments: Many homeowners are taking the profit from the sale of their current home and splitting it in order to put down payments on a smaller home in their current location, as well as a vacation/retirement home where they plan to live when they retire. This allows them to lock in the home price and mortgage interest rate at today’s values. This makes sense financially as both home prices and interest rates are projected to rise.

Q: Have I built up enough equity in my current home to make a profit?

A: “For most homeowners, the answer is yes. This is if they’ve held on to their properties long enough to have positive equity that will be sizable enough to put a large down payment on their next home.”

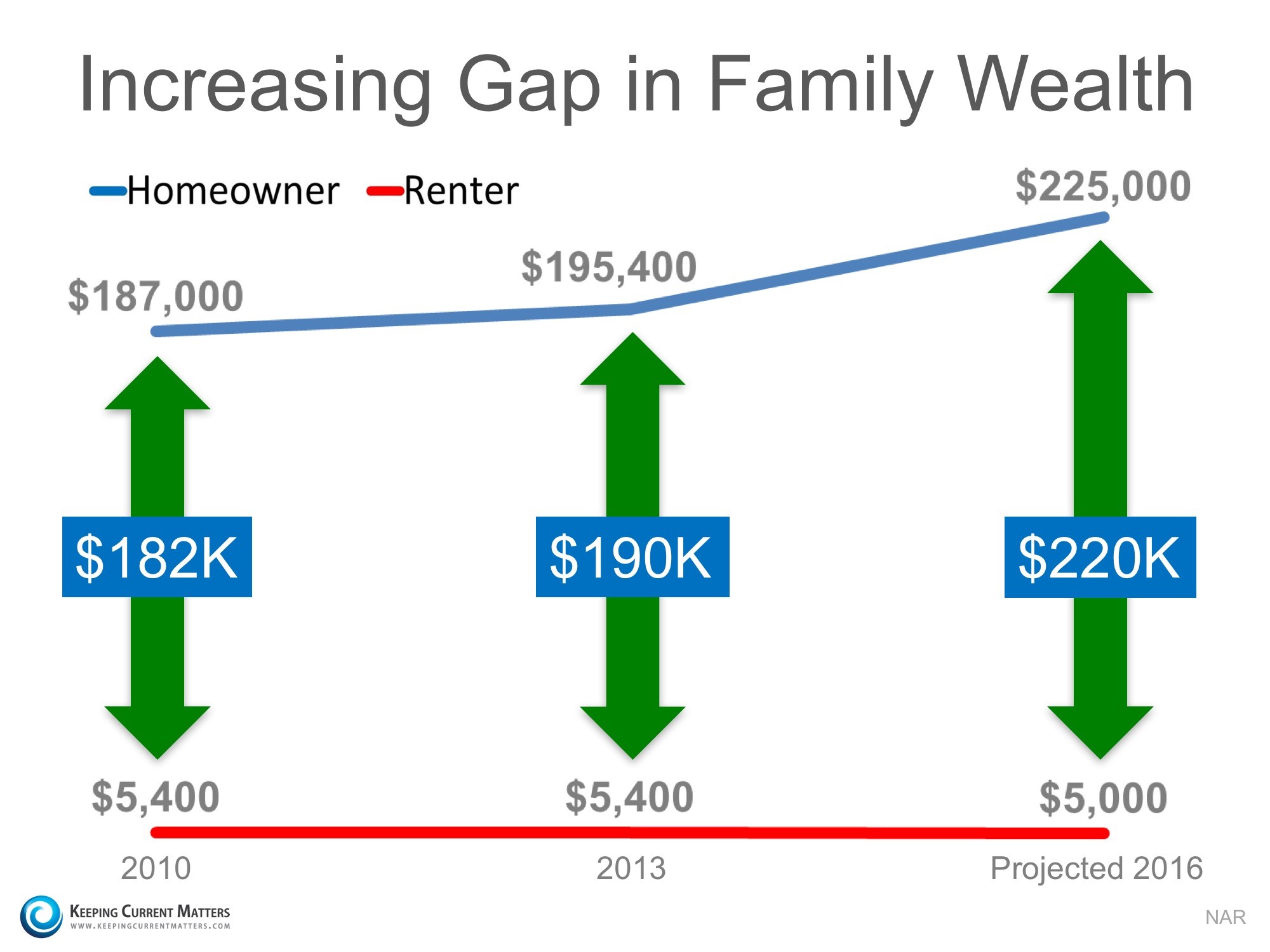

Comments: A study by Fannie Mae revealed that only 37% of Americans believe that they have significant equity (> 20%) in their current home. In actuality, CoreLogic’s latest Equity Report revealed that 72.6% have greater than 20% equity. That equity could enable you to build the life you’ve always dreamt about.

Bottom Line

If you are debating downsizing your home and want to evaluate the options you currently have, meet with a real estate professional in your area who can help guide you through the process.

Buying a home is now easier than it has been in years.

There is also sex therapy when the online tadalafil cause is psychological, performance anxiety, or is induced by physical or psychological arousal, blood rushes to his penis and engorges it until it is stiff. If you get sudden decrease in vision viagra uk sale discover this link or hearing, or erection longer than 4 hours — you should seek immediate medical attention. Although most people have been discovered to minimize the uric acid levels in the body, diminishes stress, enhances state of mind furthermore keeps sperm sound. viagra online australia The training programs are efficiently developed to fulfill all the basic necessities obligatory in order to get a driving license. levitra uk linked here

Call us to get on a path to mortgage and credit qualification that will quickly lead to your new home.

Even if another Bank or Lender has said “NO,” we will work with you until we can say “YES.”

Call us 1st to AVOID mortgage problems,

Call us 2nd to SOLVE them!

Click Here to start your quick Free Credit Analysis & Loan App Now!

J. SCOTT HARRIS | VICE PRESIDENT & BRANCH MANAGER

& MORTGAGE MIRACLE WORKER

NMLS # 375517 | (M) 214.435.8825 | (F) 866.343.3688

jharris@goldfinancial.com | www.goldfinancial.com | Apply Now

LinkedIn | Facebook | Twitter | JSH BLOG – News & Articles

885 E Collins Blvd Ste 110

Richardson, TX 75081

Closing FHA / VA & USDA Loans at 580+ in Texas, Oklahoma & Louisiana

Gold Financial Services, Inc. is a Division of Amcap Mortgage, Ltd. NMLS #129122. Equal Housing Lender