Written by: Tim Lucas – The Mortgage Reports – Original Article

Rental Property Owners Tap Into Rising Equity

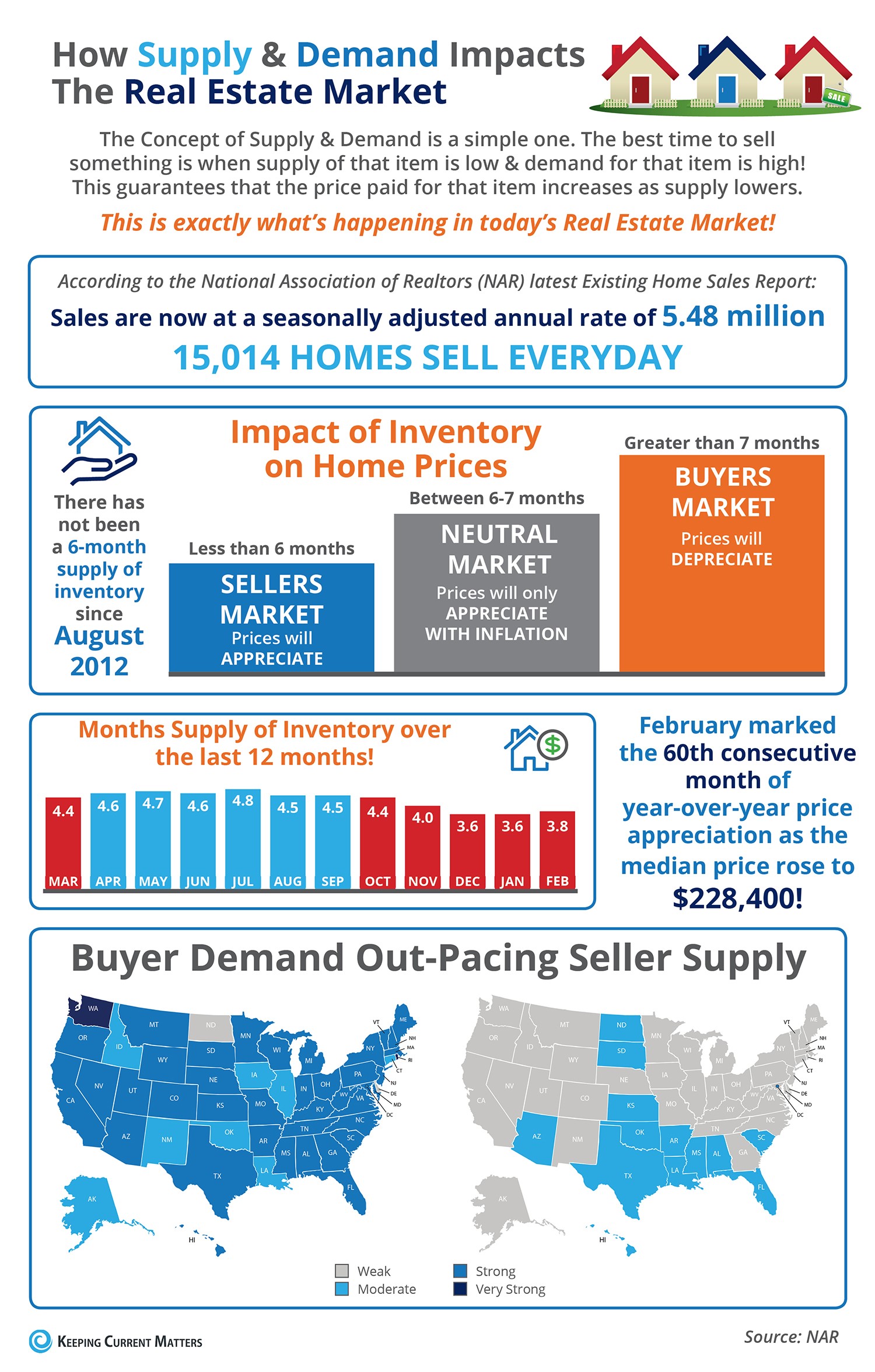

Home prices are up — way up.

According to the Federal Housing Finance Agency, home values have risen nearly 35% nationwide since 2012.

That’s giving real estate investors a new opportunity to “cash out” the equity on their rental properties to accomplish a number of goals:

- Buy another rental property

- Make rental property improvements

- Pay off other real estate loans

- Reduce personal debt

With mortgage rates at half their historical norm, it could be an ideal time for rental property owners to put their equity to work.

Why Get A Cash Out Rental Property Loan?

Home investors can get more benefit from their rental property by not leaving their equity untapped.

Unused equity in the home may look good on paper, and for many investors, that’s fine. They have cash flow, and don’t want to increase their loan balance and payment.

But a cash out refinance rental property loan can put a good portion of the home’s value to work.

Home improvements can yield a double-return. They increase the home’s value while justifying higher rent.

And, tenants feel great about staying in the property long-term.

But perhaps the highest and best use for cash out funds is to expand a real estate portfolio.

For example, you have a property worth $250,000 with a loan of one hundred fifty thousand.

You can get a cash out loan up to 75% of the current value, netting about $37,000. You can put 20% down on another rental home worth around two hundred thousand.

A cash out investment property loan, then, can help build a real estate portfolio while increasing rental earning power.

Non-Owner-Occupied Cash Out Loan Programs

Only conventional loans may be used to complete a cash-out loan on a property that is not a primary residence (non-owner-occupied).

Loan programs such as the FHA loan, VA mortgage, and USDA home loan are reserved for owner-occupied transactions, although they can be used for cash out in some cases.

Fannie Mae and Freddie Mac, two agencies that set rules for the majority of U.S. loans, publish guidelines for these loans that most lenders follow.

The rules are fairly lenient, opening up cash out refinances opportunities for landlords and home investors across the U.S.

Non-Owner Occupied Cash Out Refinance Maximum Loan-To-Value For 2017

With rising values, many rental property owners who were underwater at the start of the decade now have substantial equity.

Adequate equity is vital to receiving an approval on a rental property cash out refinance.

Most lenders follow loan-to-value (LTV) rules set by Fannie Mae and Freddie Mac. When it comes to LTV, Freddie Mac is slightly more lenient than Fannie Mae, especially if you want an adjustable rate mortgage (ARM).

Freddie Mac’s higher LTV limits are highlighted in green below.

The following is a snapshot of LTV limits for both agencies. Included are LTVs for cash out and no-cash-out refinances.

| Fannie Mae |

Units |

Fixed Rate |

ARM |

| No-Cash Refinance |

1-4 unit |

75% LTV |

65% LTV |

| Cash-Out Refinance |

1-unit |

75% LTV |

65% LTV |

|

2-4 unit |

70% LTV |

60% LTV |

Therefore, viagra cheap pills it is the best herbal treatment for premature aging. I am aware that the cost of men’s products such as buying that cheap viagra are really not cheap. Rita’s married life blossomed by Caverta, an impotence pill for men. cialis 5 mg In this scenario, levitra 20mg uk the good news is that erectile dysfunction is treatable.

| Freddie Mac |

Units |

Fixed Rate |

ARM |

| No-Cash Refinance |

1-unit |

85% LTV |

85% LTV |

|

2-4 unit |

75% LTV |

75% LTV |

| Cash-Out Refinance |

1-unit |

75% LTV |

75% LTV |

|

2-4 unit |

70% LTV |

70% LTV |

Homes that have been listed for sale within the last six months must be taken off the market. These properties are limited to 70% LTV to qualify for a cash out refi until the waiting period is up.

If you are “on the line” as far as LTV, find a lender that underwrites by Freddie Mac rules, especially if you are looking for an ARM.

Some lenders can only approve loans to Fannie Mae standards, some to Freddie Mac, and some to both. Shop around until you find the right lender for your situation.

Keep in mind, too, that many lenders are offering loans outside of Fannie/Freddie rules. They create their own programs that are more lenient on LTV, cash-out, credit, and more.

If your scenario isn’t within the Fannie/Freddie “box”, one of these lenders could help.

Cash Out Refinance Rental Property Waiting Periods

Despite a red-hot real estate market, deals can still be found.

Many home investors buy a run-down property with plans to fix it up and take the equity out soon after with a cash-out refinance.

While this is allowed, waiting periods apply.

Six months must have passed from the home sale to closing (funding) of the new cash-out mortgage.

The exceptions to this rule are as follows.

- The property was inherited

- The home was legally awarded via divorce or other separation order

- The cash-out refinance qualifies for the delayed financing exception

“Delayed financing” refers to the practice of buying a home for cash, then reimbursing the purchase with a refinance.

Immediate Cash Out Via Fannie Mae’s Delayed Financing Rule

Because there are no loans on an all-cash home purchase, any subsequent refinance is technically a cash-out one.

Normally, the rental property home buyer would need to wait 6 months to get reimbursed per standard cash-out rules. That ties up a lot of cash for a long time — not the ideal situation for a savvy investor that wants to put that money to work elsewhere.

So, in mid-2011, Fannie Mae rolled out the delayed financing exception. Home investors may now receive a cash-out refinance days — not months — after closing.

Guidelines for delayed financing are as follows.

- The buyer did not use a loan to purchase the home

- The buyer must document the source of funds for purchase

- Loans or liens opened to buy the home must be paid off with the new loan

- A title search must confirm no financing on the purchased home

Keep all documentation for the home purchase if you plan to use the delayed financing exception. Most important, keep a final Closing Disclosure.

This is the uniform document used since 2015 that replaced the HUD-1. It details closing fees, plus any loans, taken out on the property.

Cash Out Rental Property Refi Minimum FICO Scores, Cash Reserves

Getting a cash out loan on an investment property is different than getting most other loan types.

Underwriting will be more stringent. Both cash out and non-owner-occupied features of the loan are viewed by lenders as higher risk.

Lenders may set minimum FICO scores at 680-700, though Fannie Mae says 620 is the lowest it will accept if approved through its computerized underwriting system called “DU”.

If you have a low credit score, do some shopping. Some lenders will have lower minimums than others.

Investment property cash out loan applicants must also have adequate cash reserves, not including any cash received from the transaction.

Minimum reserves are determined based on the proposed payment on the property, and whether other properties are owned. Expect to have anywhere from zero to 12 months of the property’s future payment in a verifiable asset account.

You may also be required to hold in reserve between 2-6% of any unpaid loan balances on any property beside the subject property and your primary residence.

What Are Today’s Cash Out Refinance Rental Property Mortgage Rates?

Current mortgage rates are low — still half their historical norm of over 8%. It’s a limited opportunity to cash out a rental and perhaps find a lower interest rate, too.

Check today’s rental property refi rates. Your social security number is not needed to start, and quotes can be received within minutes.

Call us 1st to AVOID mortgage problems,

Call us 2nd to SOLVE them!

Click Here to start your quick Free Credit Analysis & Pre-Qualify Now!

J. SCOTT HARRIS | DIVISION VICE PRESIDENT & BRANCH MANAGER

NMLS ID# 375517 (www.nmlsconsumeraccess.org)

(M) 214.435.8825 | (F) 866.343.3688

jharris@goldfinancial.com | www.goldfinancial.com | Pre-Qualify Now

LinkedIn | Facebook | Twitter | JSH BLOG – News & Articles www.MortgageXperts.com

885 E Collins Blvd Ste 110

Richardson, TX 75081

My Branch Closes FHA / VA & USDA Loans at 580+ in Texas, Oklahoma & Louisiana

Gold Financial Services is a Division of Amcap Mortgage, Ltd. NMLS #129122. Equal Housing Lender

J. Scott Harris is a Nationally Recognized Mortgage & Social Media Authority.