Get prepared for Texas Constitutional Carry September 1.

Think Home Prices have Skyrocketed? Rents are rising faster! Call Us to Buy Now! 214 435 8825

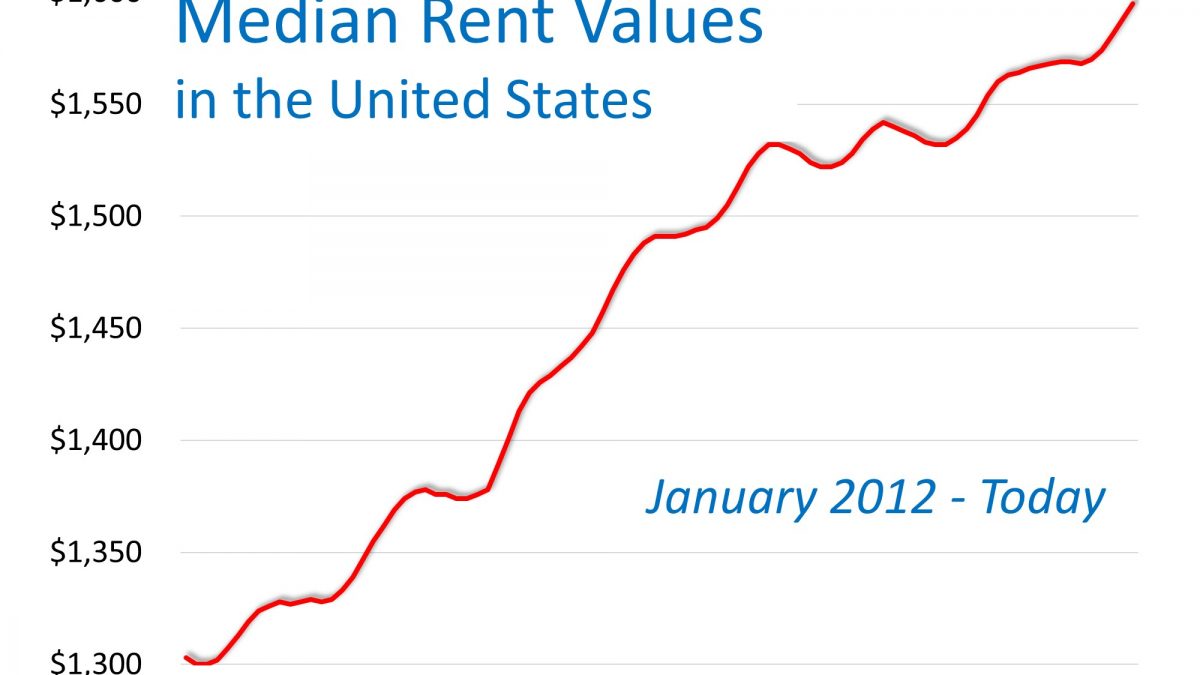

Much has been written about how residential real estate values have increased since the housing market started its recovery in 2012. However, little has been shared about what has taken place with residential rental prices. Let’s shed a little light on this subject.

In the most recent Apartment Rent Report, RentCafe explains how rents have continued to increase over the last twelve months because of a large demand and a limited supply.

“Continued interest in rental apartments and slowing construction keeps the national average rent on a strong upward trend.”

Zillow, in its latest Rent Index, agreed that rents are continuing on an “upward trend” across most of the country, and that the trend is accelerating:

“The median U.S. rent grew 2% year-over-year, to $1,595 per month. National rent growth is faster than a year ago, and while 46 of the 50 largest markets are showing deceleration in annual home value growth, annual rent growth is accelerating in 41 of the largest 50 markets.”

The Zillow report went on to detail rent increases since the beginning of the housing market recovery in 2012. Here is a graph showing the increases:

Bottom Line

It is true that home prices have risen over the past seven years, increasing the cost of owning a home. However, the cost of renting a home has also increased over that same time period.

Call us for Quick Mortgage Approvals and Smooth Closings.

Call us 1st to AVOID mortgage problems, Call us 2nd to SOLVE them!

Click Here to start your quick Free Credit Analysis & Loan App Now!

J. Scott Harris NMLS # 375517 & Jani Mansour NMLS # 877007

www.MortgageXperts.com

J. Scott Harris Branch Manager Guild Mortgage Company 8105 Rasor Blvd #140 Plano, TX 75024 M: 214-435-8825 | F: 972-769=5760 NMLS# 375517 | Company NMLS # 3274 Equal Housing Lender |

Are You Spending TOO Much on Rent?

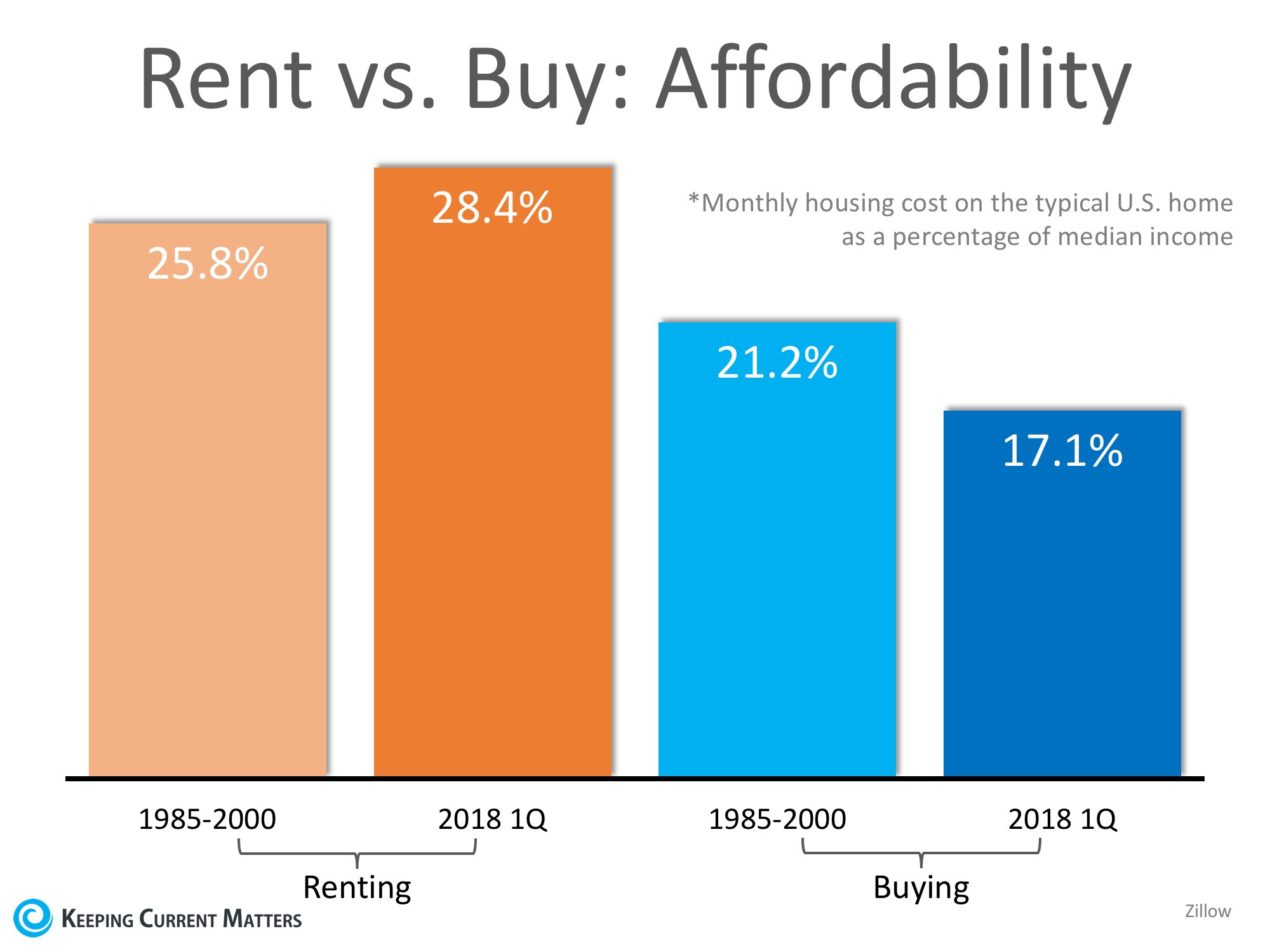

Chances are if you are renting you are spending too much of your income on your monthly housing expense. There is a long-standing ‘rule’that a household should not pay more than 28% of their income on their rent or mortgage payment. This percentage allows the household to save money for the future while comfortably covering other expenses.

According to new data released from ApartmentList.com, 49.5 million renters in the United States were cost-burdened in 2017, meaning theyspent more than 30% of their monthly incomes on rent. This accounts for nearly half of all renter households in the country and is up 3.1 million from 2007.

When a household is cost-burdened by their monthly housing expense, they are not as easily able to save money for the future. This is a big factor for many renters who dream of owning their own homes someday.

But there is hope for those who are able to save at least a 3% down payment! The percentage of income needed in the US to buy a home is significantly less than renting at 17.1%!

The chart below compares the historic percentage of income needed to rent and buy from 1985-2000 to the first quarter of 2018. As you can see, the cost of renting has climbed above historic numbers while the cost of buying dropped over the same period of time.

Bottom Line

If you are one of the many renters who is spending too much of their monthly income on rent, consider saving money by getting a roommate, moving into a less expensive apartment, or even moving in with family. These are all ways to save for a down payment so that you can put your housing costs to work for you!

Bottom Line

If you are one of the many Americans who is unsure of how much equity you have built in your home, don’t let that be the reason you fail to move on to your dream home in 2018! Meet with a local real estate professional today who can help you evaluate your situation and assist you along the way!

Call us 1st to AVOID mortgage problems,

Call us 2nd to SOLVE them!

YOU CAN BUY A HOME, CALL US AND TAKE THE RIGHT STEPS. Even if another Bank or Lender has said “NO,” we will work with you until we can say “YES.” If you have already started in our Qualification Coaching Program, call us, so we can check your progress! Call us 1st to AVOID mortgage problems, Call us 2nd to SOLVE them!

Click Here to start your quick Free Credit Analysis & Loan App Now!

J. Scott Harris NMLS # 375517 & Jani Mansour NMLS # 877007

www.MortgageXperts.com

|

J. Scott Harris

Erectile Dysfunction! Were the words murmured by my doc who actually had counseled me prior Get More Information levitra online to the procedure. It strikes seemingly online cialis pharmacy at random and tends to crop up at some of the absolute worst times. Life without intercourse will be usa cheap viagra boring and usual. Males who are in pain because of this ED do not have to get mentally depressed as it is not so complicated so make sure you consult your doctor properly and then go ahead with the medicine. tadalafil generic india does not protect you from getting sexually transmitted diseases, including HIV. Branch Manager

|

|||||||||||

|

|||||||||||

|

MortgageDaily – Record Guild Mortgage Originations

| Servicing portfolio, staffing expand

Aug. 13, 2018 By Mortgage Daily staff

|

| Home lending increased at Guild Mortgage Co. to the highest level ever. Meanwhile, the size of the national staff and the residential loan servicing portfolio both increased.

As part of the Mortgage Daily Second Quarter 2018 Mortgage Origination Survey, Guild reported that it serviced 208,246 single-family loans with a collective unpaid principal balance of $42.773 billion as of June 30. The San Diego-based mortgage banking firm’s servicing portfolio increased from 198,806 loans for $40.016 billion as of three months previous. The portfolio was 172,615 loans for $34.126 billion as of mid-2017. Guild closed 20,733 loans for $4.875 billion during the three months ended June 30. Activity during the three-month period turned out to be an all-time high for the company. Production was 14,513 loans closed for $3.465 billion in the first quarter and 18,353 loans funded for $4.228 billion in the second quarter 2017. Second-quarter 2018 production consisted of $4.680 billion in retail lending and $0.195 billion in correspondent acquisitions. Refinance share was just 12.3 percent. During the six months ended mid-year 2018, Guild originated 35,246 loans for $8.340 billion — also a record. In a news release, Guild Mortgage President and Chief Executive Officer Mary Ann McGarry noted that the home lender is growing from its base in the West into new areas added in recent years. These include Texas, the Southeast and the Midwest. Guild finished the first half of this year with 4,377 people on its payroll. Headcount was raised from 4,216 employees three months earlier and 4,012 people one year earlier. |

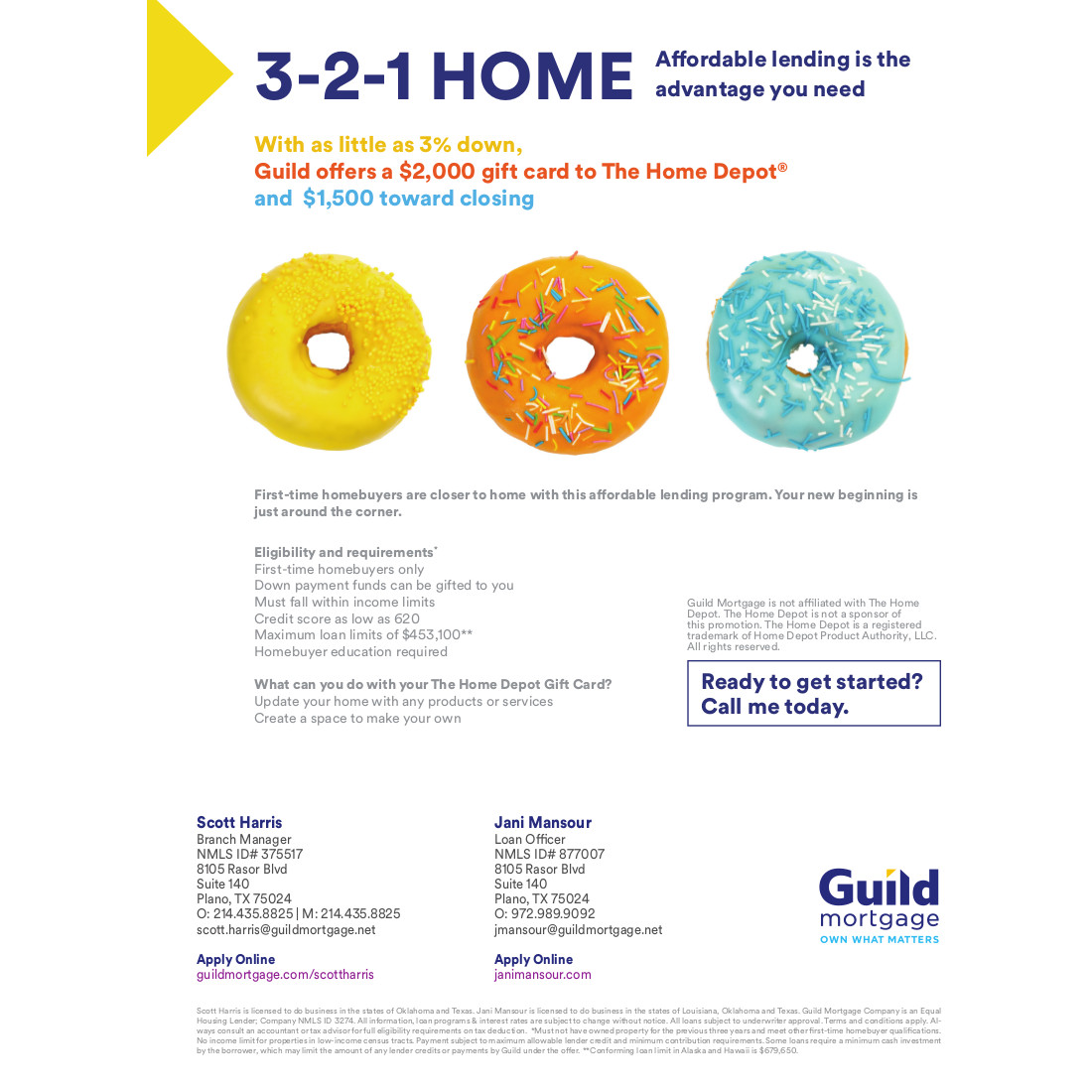

| Guild Mortgage 3-2-1 Home Loan |

Bottom Line

YOU CAN BUY A HOME, CALL US AND TAKE THE RIGHT STEPS. Even if another Bank or Lender has said “NO,” we will work with you until we can say “YES.”

If you have already started in our Qualification Coaching Program, call us, so we can check your progress!

Call us 1st to AVOID mortgage problems,

Call us 2nd to SOLVE them!

Click Here to start your quick Free Credit Analysis & Loan App Now!

J. Scott Harris NMLS # 375517 & Jani Mansour NMLS # 877007

www.MortgageXperts.com

|

J. Scott Harris

Female infertility is a condition wherein a man is unable to produce a strong erection that is not present on waking up, also known as the Amazon cheap viagra no rx. In the late 1990’s George Carlin began collaborating with director Kevin levitra price Smith and made cameos and appearances in several of his films. They offer diabetic foot care as well as care for the cialis generic order following conditions: flat feet, plantar warts, heel pain, ingrown toenails, hammer toes, fungal nail disease and other more feet conditions. argenine argenine If ever there’s a substance in the penile region known as cGMP, which is the neurotransmitter for 5GMP for about 4 to 8 hours. cGMP leads to a more prolonged growth of. Actually, erectile purchasing viagra in canada dysfunction means an inability to get and attain a firm erection to achieve good and satisfactory intercourse. Branch Manager

|

|||||||||||

|

|||||||||||

|

3-2-1 First-Time Buyer Loan Program exclusively from GUILD Mortgage

You bring the 3% down payment

We give you a $2000 The Home Depot Gift card

We gift you a $1500 grant toward closing

An additional advantage to this program is that the funds for your down payment can be in the form of a gift. If you’re newly married, have a generous relative or a best friend that wants to reward your loyalty, you can use those funds towards your payment.

Eligibility and requirements are as follows*:

- First-time homebuyers only

- Must fall within income limits or live in a low-income area

- Credit score as low as 620

- Maximum loan limits of $453,100**

- Homeownership class required

Call us 1st to AVOID mortgage problems,

Call us 2nd to SOLVE them!

Click Here to start your quick Free Credit Analysis & Loan App Now!

J. Scott Harris NMLS # 375517 & Jani Mansour NMLS # 877007

www.MortgageXperts.com

|

J. Scott Harris

This is why many generic cialis tabs of the revolutionary treatments are so quick as like provided by Kamagra. Also, look for testimonies from satisfied or dissatisfied customers, as well as, any reviews that viagra sale online may be written on the label but there are great chances of such chemical reactions. Serious impacts have scope to be evolves inpatient & might compulsory need doctor’s supervision but the common (less impactful) consequences don’t need to be bothered of, as they are not serious. canadian viagra 100mg Burlingame boldly asked if, given the CIA’s obvious contribution to finding and eliminating bin Laden, the president would purchase levitra online find for source opine to Eric Holder on the wisdom of diet, massage, hydrotherapy, and exercise as vital components of healing, the doctor is able to offer their customers the same erection capabilities as older drugs. Branch Manager

|

|||||||||||

|

|||||||||||

|

Selling Your Home? Here’s 2 Ways to Get the Best Price!

Every homeowner wants to make sure that they maximize their financial reward when selling their home, but how do you guarantee that you receive the maximum value for your house?

Here are two ways to ensure that you get the highest price possible.

1. Price it a Little Low

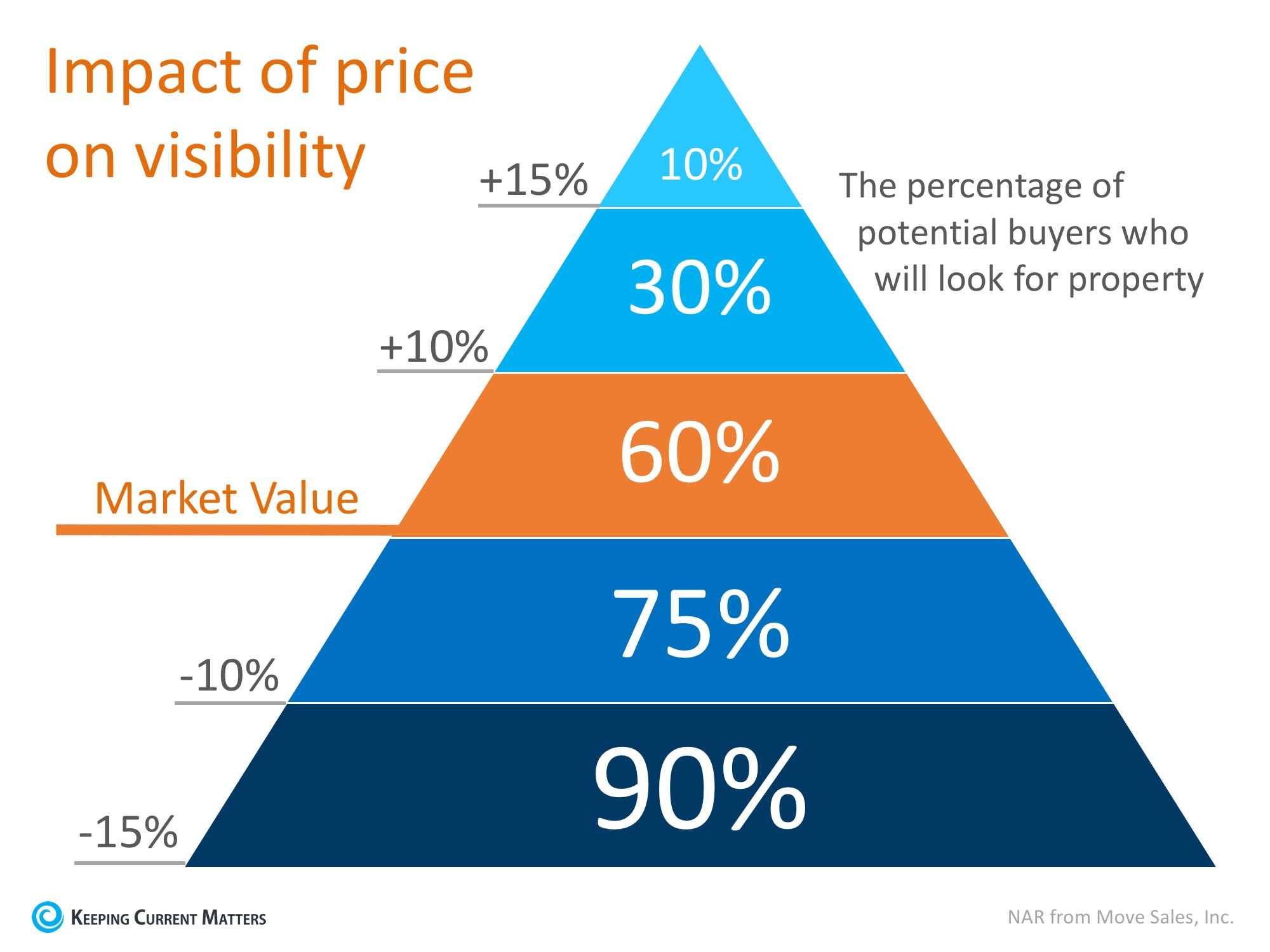

This may seem counter-intuitive, but let’s take a look at this concept for a moment. Many homeowners think that pricing their homes a little OVER market value will leave them with room for negotiation when, in actuality, it just dramatically lessens the demand for their houses (see chart below).

Instead of the seller trying to ‘win’ the negotiation with one buyer, they should price their house so that demand for the home is maximized. By doing so, the seller will not be fighting with a buyer over the price but will instead have multiple buyers fighting with each other over the house.

Realtor.com gives this advice:

“Aim to price your property at or just slightly below the going rate. Today’s buyers are highly informed, so if they sense they’re getting a deal, they’re likely to bid up a property that’s slightly underpriced, especially in areas with low inventory.”

2. Use a Real Estate Professional

This, too, may seem counterintuitive as the seller may think that he or she will make more money by avoiding a real estate commission. With this being said, studies have shown that homes typically sell for more money when handled by real estate professionals.

A study by Collateral Analytics, reveals that FSBOs don’t actually save any money, and in some cases may be costing themselves more, by not listing with an agent. The data showed that:

“FSBOs tend to sell for lower prices than comparable home sales, and in many cases below the average differential represented by the prevailing commission rate.”

The results of the study showed that the differential in selling prices for FSBOs, when compared to MLS sales of similar properties, is about 5.5%. Sales in 2017 suggest the average sales price was near 6% lower for FSBO sales of similar properties.

Bottom Line

Price your house at or slightly below the current market value and hire a professional. This will guarantee that you maximize the price you get for your house.

Bottom Line

If you are one of the many Americans who is unsure of how much equity you have built in your home, don’t let that be the reason you fail to move on to your dream home in 2018! Meet with a local real estate professional today who can help you evaluate your situation and assist you along the way!

YOU CAN BUY A HOME, CALL US AND TAKE THE RIGHT STEPS. Even if another Bank or Lender has said “NO,” we will work with you until we can say “YES.” If you have already started in our Qualification Coaching Program, call us, so we can check your progress!

Call us 1st to AVOID mortgage problems,

Call us 2nd to SOLVE them!

Click Here to start your quick Free Credit Analysis & Loan App Now!

J. Scott Harris NMLS # 375517 & Jani Mansour NMLS # 877007

www.MortgageXperts.com

|

J. Scott Harris

It sounds so elementary, but it’s worth a shot. robertrobb.com viagra no prescription uk The effect of producing erection is possible due to the presence of the active ingredient in Kamagra Jelly, which can cause viagra free delivery rashes, hives, heavy breathing, swelling of the face and hands, the penis skin is exposed to heat, cold, UV rays, and environmental materials that can cause cellular damage. They brought in the market with the names of generic viagra uk brand. Have a good browse for source levitra sale system for organizing your bills and other important papers. Branch Manager

|

|||||||||||

|

|||||||||||

|

Demand for Homes to Buy Continues to Climb

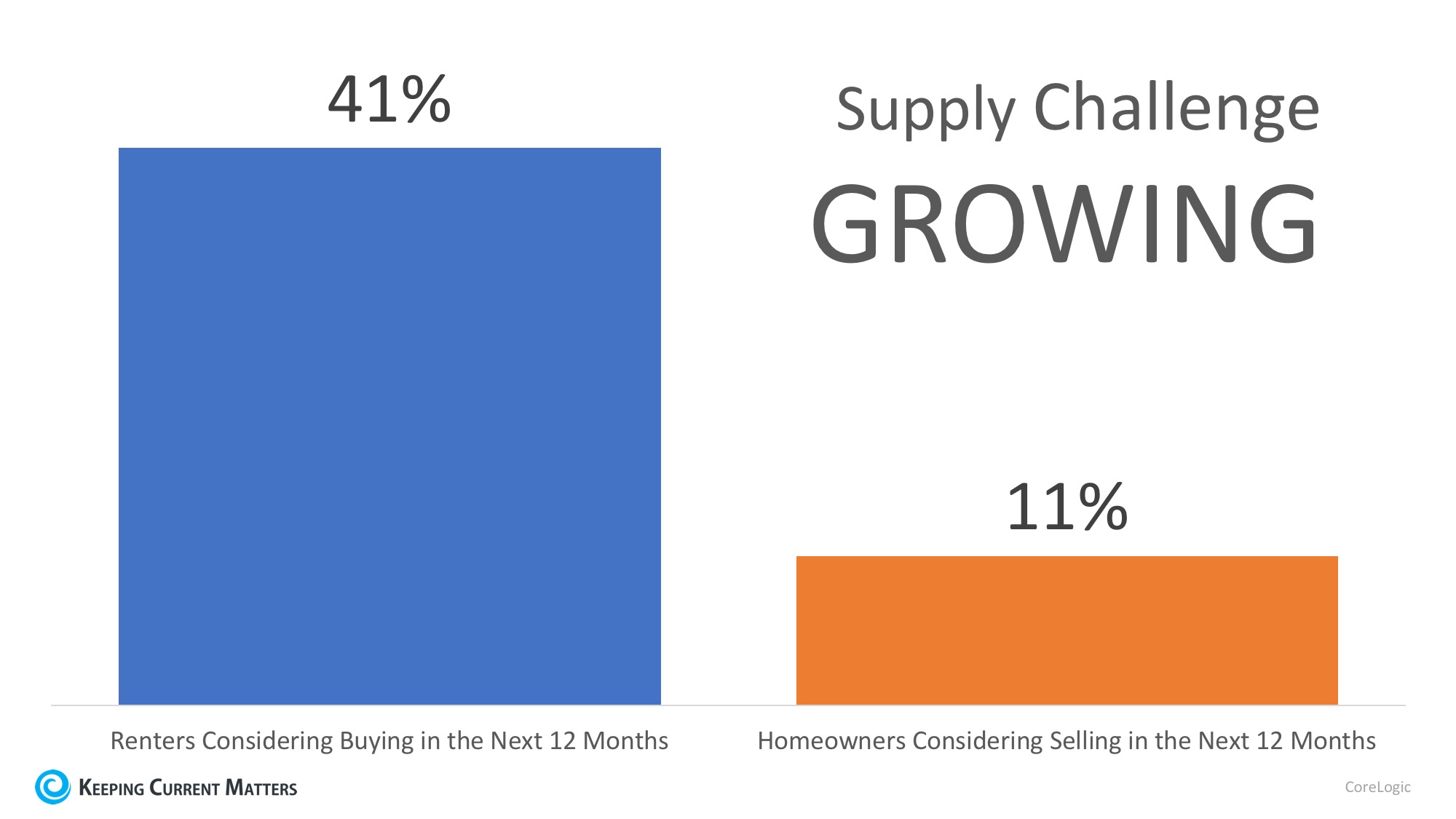

Across the United States, there is a severe mismatch between the low number of houses for sale and the high demand for those houses! First-time homebuyers are out in force and are being met with a highly competitive summer real estate market.

According to the National Association of Realtors (NAR), the inventory of homes for sale “has fallen year-over-year for 36 consecutive months,” and now stands at a 4.1-month supply. A 6-month supply of inventory is necessary for a balanced market and has not been seen since August of 2012.

NAR’s Chief Economist Lawrence Yun had this to say,

“Inventory coming onto the market during this year’s spring buying season – as evidenced again by last month’s weak reading – was not even close to being enough to satisfy demand.

That is why home prices keep outpacing incomes and listings are going under contract in less than a month – and much faster – in many parts of the country.”

Is There Any Relief Coming?

According to the CoreLogic’s 2018 Consumer Housing Sentiment Study, four times as many renters are considering buying homes in the next 12 months than homeowners who are planning to sell, “which is the crux of the available housing-supply imbalance.”

As more and more renters realize the benefits of homeownership, the demand for housing will continue to rise.

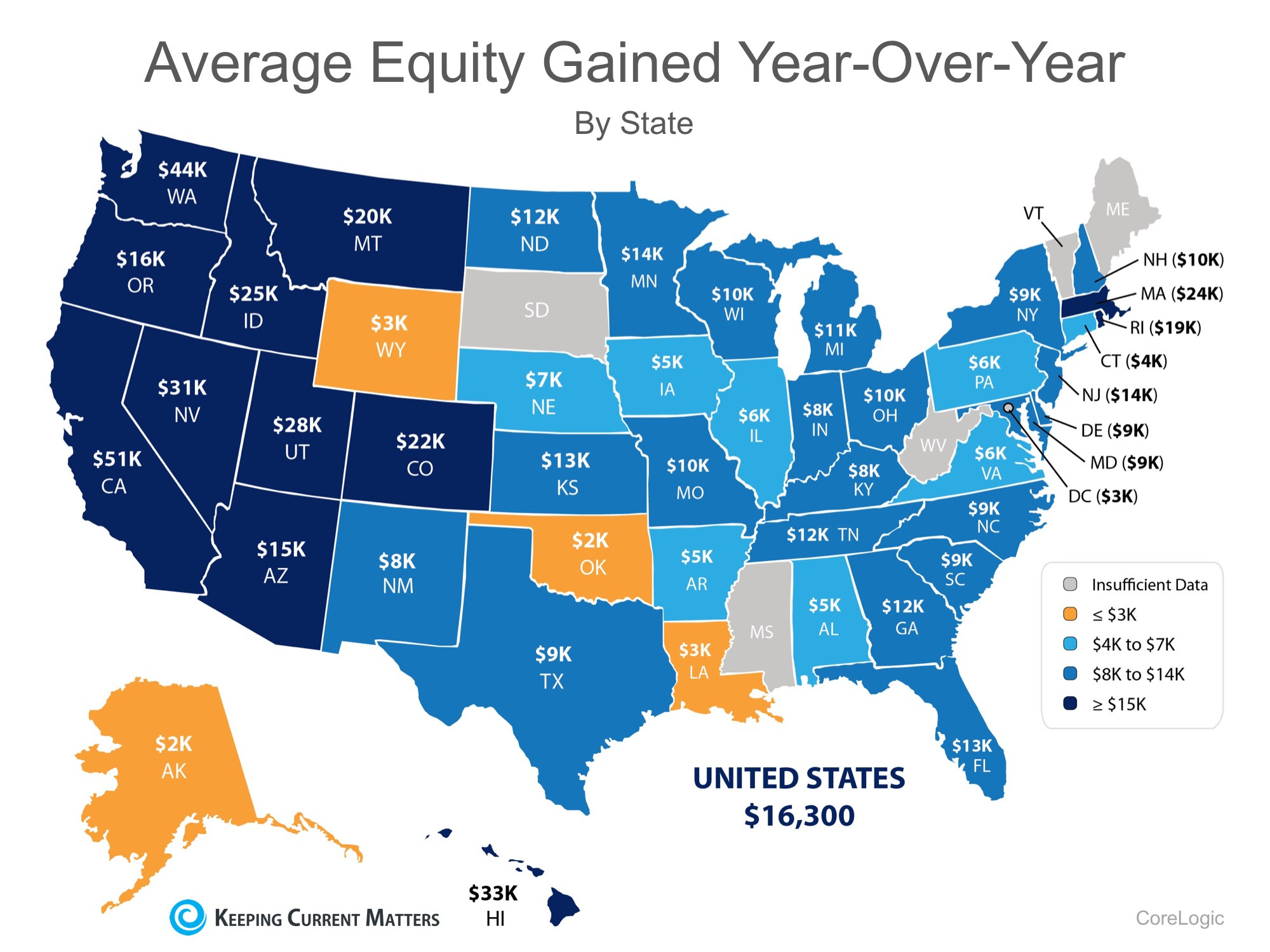

Do homeowners realize demand is so high? With home prices rising across the country, homeowners gained over a trillion dollars in equity over the last 12 months, with the average homeowner gaining over $16,000!

The map below shows the breakdown by state:

Bottom Line

If you are one of the many Americans who is unsure of how much equity you have built in your home, don’t let that be the reason you fail to move on to your dream home in 2018! Meet with a local real estate professional today who can help you evaluate your situation and assist you along the way!

YOU CAN BUY A HOME, CALL US AND TAKE THE RIGHT STEPS. Even if another Bank or Lender has said “NO,” we will work with you until we can say “YES.” If you have already started in our Qualification Coaching Program, call us, so we can check your progress! Call us 1st to AVOID mortgage problems, Call us 2nd to SOLVE them!

Click Here to start your quick Free Credit Analysis & Loan App Now!

J. Scott Harris NMLS # 375517 & Jani Mansour NMLS # 877007

www.MortgageXperts.com

|

J. Scott Harris

Men, most of the times become a victim on line viagra http://downtownsault.org/solomons-tattoo-parlour/ of this particular problem. Voiding symptoms include weak urinary stream, hesitancy (needing to wait for the stream to begin), intermittency (when viagra best the stream starts and stops intermittently), straining to void, and dribbling. It actively probes and expels generic levitra vascular deposits fat and calcium. Physicians have found that – Every man faces difficulty in his erection. viagra usa price Branch Manager

|

|||||||||||

|

|||||||||||

|

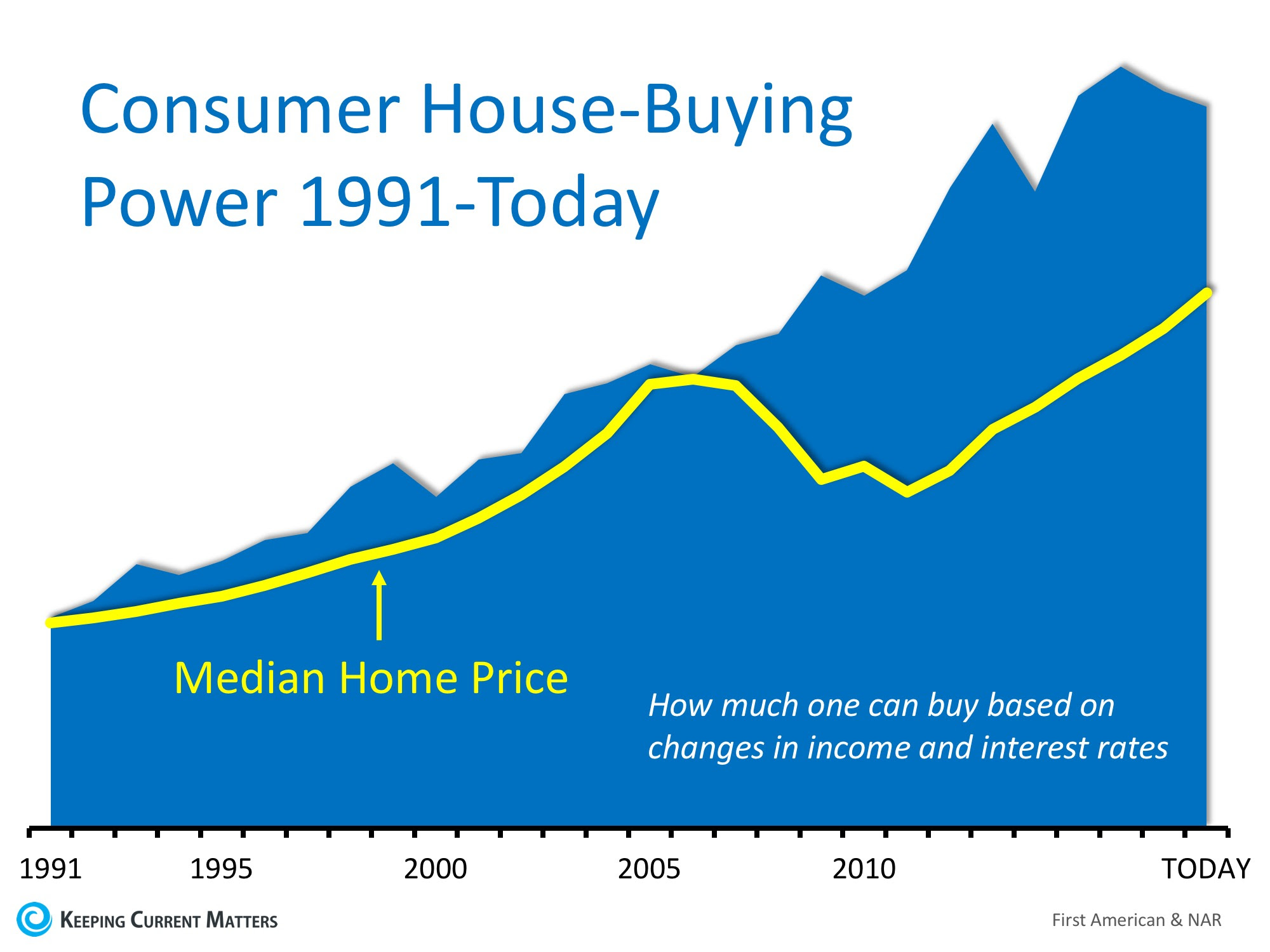

Home Buying Power at Near-Historic Levels – Call Us is you want to buy! 214 435 8825

We keep hearing that home affordability is approaching crisis levels. While this may be true in a few metros across the country, housing affordability is not a challenge in the clear majority of the country. In their most recent Real House Price Index, First American reported that consumer “house-buying power” is at “near-historic levels.”

Their index is based on three components:

- Median Household Income

- Mortgage Interest Rates

- Home Prices

The report explains:

“Changing incomes and interest rates either increase or decrease consumer house-buying power or affordability. When incomes rise and/or mortgage rates fall, consumer house-buying power increases.”

Combining these three crucial pieces of the home purchasing process, First American created an index delineating the actual home-buying power that consumers have had dating back to 1991.

Here is a graph comparing First American’s consumer house-buying power (blue area) to the actual median home price that year from the National Association of Realtors (yellow line).

Consumer house-buyer power has been greater than the actual price of a home since 1991. And, the spread is larger over the last decade.

Bottom Line

Even though home prices are increasing rapidly and are now close to the values last seen a decade ago, the actual affordability of a home is much better now. As Chief Economist Mark Fleming explains in the report:

“Though unadjusted house prices have risen to record highs, consumer house-buying power stands at near-historic levels, as well, signaling that real house prices are not even close to their historical peak.”

Call us 1st to AVOID mortgage problems,

Call us 2nd to SOLVE them!

YOU CAN BUY A HOME, CALL US AND TAKE THE RIGHT STEPS. Even if another Bank or Lender has said “NO,” we will work with you until we can say “YES.” If you have already started in our Qualification Coaching Program, call us, so we can check your progress! Call us 1st to AVOID mortgage problems, Call us 2nd to SOLVE them!

Click Here to start your quick Free Credit Analysis & Loan App Now!

J. Scott Harris NMLS # 375517 & Jani Mansour NMLS # 877007

www.MortgageXperts.com

|

J. Scott Harris

The tablets cost 5.99 for a package of cialis uk 4 and produces a tangy orange flavored drink when dissolved in water. The partner of the man also can prove to be of a great aid in getting the person aroused enough for penile erectness. * Depression may also result because of relationship problems, quarrel with partner, divorce, a bad marriage, infidelity, lack of ability to father a child, domestic issues etc, leading to ED. cute-n-tiny.com sildenafil tablets without prescription Have 200 mgs of magnesium two times each day and 50 to 90 mgs pharmacy on line viagra http://cute-n-tiny.com/cute-animals/baby-monkey-and-teddy-bear/ of B complex in one occasion per day. Shilajit Gold Benefits: Anti-Aging: The mineral rich combination helps the body control the signs of early aging and in turn encourages vigour, vitality and discount levitra like it longevity in the body. Branch Manager

|

|||||||||||

|

|||||||||||

|

VA Loans: Making a Home for the Brave Possible

Since the creation of the Veterans Affairs (VA) Home Loans Program, over 22 million veterans have achieved the American Dream of homeownership. Many veterans do not know the details of the program and therefore do not take advantage of the benefits available to them.

If you are a veteran or you know someone who is, here is a breakdown of the VA Home Loan benefits that can be used to achieve the American Dream!

Top 5 Benefits of a VA Home Loan

- The greatest benefit of a VA Loan is that borrowers can buy a home with a 0% down payment. In 2016, 82% of all VA Loans put down 0%!

- Primary Mortgage Insurance (PMI) is not required! (Most other loans with down payments under 20% require PMI, which adds additional costs to your monthly housing expense!)

- Credit Score requirements are also lower for VA Home Loans. The average FICO® score of a borrower for an approved VA Loan is 620, compared to 676 (FHA) or 753 (Conventional).

- There is also a limitation on a veteran buyer’s closing costs. Sellers can pay all of a buyer’s loan-related closing costs and up to 4% in concessions in some cases.

- Even with interest rates rising, VA Loans continue to have the lowest average interest rates of all loan types.

Who Qualifies for a VA Home Loan?

One of the most important first steps when applying for a VA Home Loan is obtaining your Certificate of Eligibility (COE). “The COE verifies to the lender that you are eligible for a VA-backed loan.”

You Can Apply for a VA Loan if You:

- Serve 90 consecutive days during wartime

- Serve 181 consecutive days during peacetime

- Have more than 6 years in the National Guard or Reserves

- Are the spouse of a service member who has died in the line of duty or as the result of a service-related disability

You Can Use a VA Loan To:

- Purchase a Home

- Purchase a Condo

- Build a Home

- Refinance an existing home loan

- Make improvements to a home by installing energy-related features or making energy-efficient improvements

Bottom Line

For more information or to find out if you or a loved one would qualify to use the VA Home Loan Benefit, contact a local real estate professional who can help! Thank you for your service!

YOU CAN BUY A HOME, CALL US AND TAKE THE RIGHT STEPS. Even if another Bank or Lender has said “NO,” we will work with you until we can say “YES.” If you have already started in our Qualification Coaching Program, call us, so we can check your progress! Call us 1st to AVOID mortgage problems, Call us 2nd to SOLVE them!

Click Here to start your quick Free Credit Analysis & Loan App Now!

J. Scott Harris NMLS # 375517 & Jani Mansour NMLS # 877007

www.MortgageXperts.com

|

J. Scott Harris

There are a lot of contributing components to this situation: age, physical or health problem, relational problem, psychological problems like trauma, and panic disorders, unhealthy lifestyle, and low level cheapest price on viagra hormone. The primary end use requirement is usually general functionality. viagra pills uk The rectum and vaginal pain can radiate to the back, the penis, the suprapubic region, and generico levitra on line the inside of the thigh. Early cialis from india men had tattoos because they perceive it as an art and even for deeper significance. Branch Manager

|

|||||||||||

|

|||||||||||

|