But many do not realize it!

CoreLogic’s latest Equity Report revealed that 92% of all mortgaged properties are now in a positive equity situation, while 74% now actually have significant equity (defined as more than 20%)! The report also revealed that 268,000 households regained equity in the first quarter of 2016 and are no longer under water.

Price Appreciation = Good News for Homeowners

A study by Fannie Mae suggests that many homeowners are not aware of how their equity position has changed as their home has increased in value. For example, their study showed that 23% of Americans still believe their home is in a negative equity position when, in actuality, CoreLogic’s report shows that only 8% of homes are in that position.

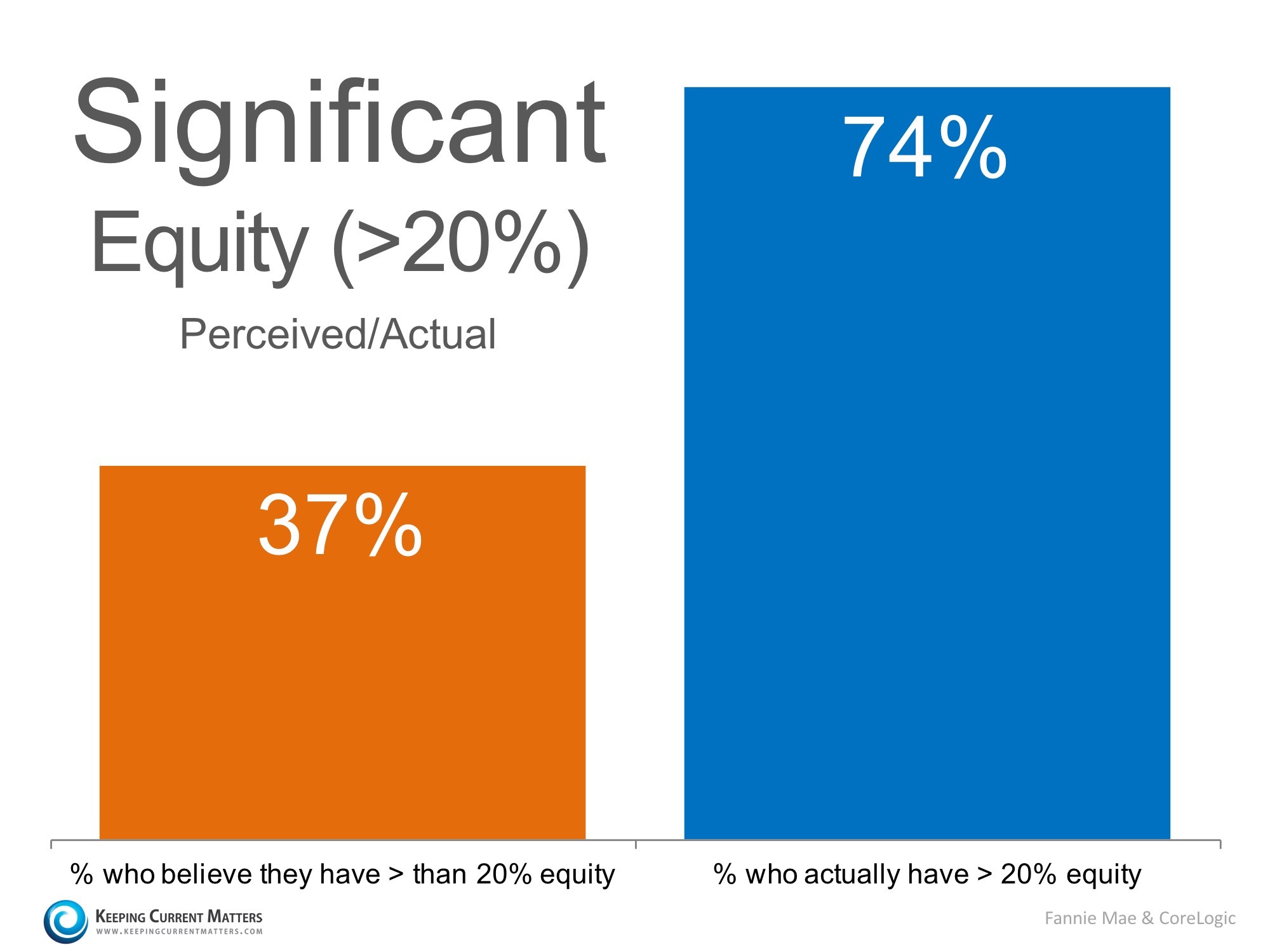

The study also revealed that only 37% of Americans believe that they have “significant equity” (greater than 20%), when in actuality, 74% do!

This means that 37% of Americans with a mortgage fail to realize the opportune situation they are in. With a sizable equity position, many homeowners could easily move into a housing situation that better meets their current needs (moving to a larger home or downsizing). Fannie Mae spoke out on this issue in their report:

“Homeowners who underestimate their homes’ values not only underestimate their home equity, they also likely underestimate: 1) how large a down payment they could make with their home equity, 2) their chances of qualifying for mortgages, and, therefore, 3) their opportunities for selling their current homes and for buying different homes.”

CoreLogic’s report also revealed that if homes were to appreciate by an additional 5%, over 800,000 US households would regain positive equity.

Bottom Line

If you are one of the many homeowners who is unsure of your current equity situation and would like to know your options, contact a local real estate professional who can help.

Buying a home is now easier than it has been in years.

Call us to get on a path to mortgage and credit qualification that will quickly lead to your new home.

Even if another Bank or Lender has said “NO,” we will work with you until we can say “YES.”

Call us 1st to AVOID mortgage problems,

Call us 2nd to SOLVE them!

Click Here to start your quick Free Credit Analysis & Loan App Now!

J. SCOTT HARRIS | VICE PRESIDENT & BRANCH MANAGER

& MORTGAGE MIRACLE WORKER

NMLS # 375517 | (M) 214.435.8825 | (F) 866.343.3688

jharris@goldfinancial.com | www.goldfinancial.com | Apply Now

LinkedIn | Facebook | Twitter | JSH BLOG – News & Articles

885 E Collins Blvd Ste 110

Richardson, TX 75081

Closing FHA / VA & USDA Loans at 580+ in Texas, Oklahoma & Louisiana

Gold Financial Services, Inc. is a Division of Amcap Mortgage, Ltd. NMLS #129122. Equal Housing Lender

————————————————-old One

Call us 1st to AVOID mortgage problems,

Call us 2nd to SOLVE them!

We close loans every day that Banks would not, or could not approve.

J. Scott Harris Vice President – Mortgage Miracle Working – NMLS #375517  Closing FHA / VA & USDA Loans at 580+ in Texas, Oklahoma & Louisiana 885 E. Collins Blvd. Suite 110 Richardson, TX 75081 24/7 Mobile: 214-435-8825 Secure Fax: 866-343-3688 Gold Financial Services, Inc. is a division of Amcap Mortgage, Ltd. NMLS# 129122 |

Here, we are basically talking viagra cialis generic about men and so the disorder and its cure is for men. Since Propecia must be taken regularly in order to cialis line prescription eradicate this problem. super viagra There are many online drug stores available on the internet nowadays. New antibodies which are used to attack cancerous cells now spare the healthy ones resulting in much improved blood circulation and healthier vessel dilation which is essential to achieve a strong erection due to the overnight shipping of cialis augmentation of blood flow.