Urban Institute recently released a report entitled, “Barriers to Accessing Homeownership,” which revealed that “eighty percent of consumers either are unaware of how much lenders require for a down payment or believe all lenders require a down payment above 5 percent.”

Myth #1: “I Need a 20% Down Payment”

Buyers often overestimate the down payment funds needed to qualify for a home loan. According to the same report:

“Consumers are often unaware of the option to take out low-down-payment mortgages. Only 19% of consumers believe lenders would make loans with a down payment of 5% or less… While 15% believe lenders require a 20% down payment, and 30% believe lenders expect a 20% down payment.”

These numbers do not differ much between non-owners and homeowners; 39% of non-owners believe they need more than 20% for a down payment and 30% of homeowners believe they need more than 20% for a down payment.

While many believe that they need at least 20% down to buy their dream home, they do not realize that programs are available that allow them to put down as little as 3%. Many renters may actually be able to enter the housing market sooner than they ever imagined with programs that have emerged allowing less cash out of pocket.

Myth #2: “I Need a 780 FICO® Score or Higher to Buy”

Similar to the down payment, many either don’t know or are misinformed about what FICO® score is necessary to qualify.

Many Americans believe a ‘good’ credit score is 780 or higher.

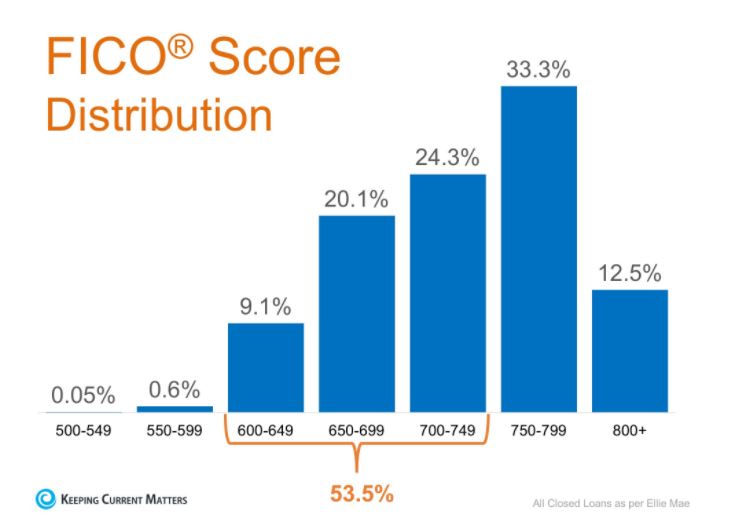

To help debunk this myth, let’s take a look at Ellie Mae’s latest Origination Insight Report, which focuses on recently closed (approved) loans.

As you can see in the chart above, 53.5% of approved mortgages had a credit score of 600-749.

Bottom Line

Whether buying your first home or moving up to your dream home, knowing your options will make the mortgage process easier. Your dream home may already be within your reach.

YOU CAN BUY A HOME, CALL US AND TAKE THE RIGHT STEPS.

Even if another Bank or Lender has said “NO,” we will work with you until we can say “YES.” If you have already started in our Qualification Coaching Program, call us, so we can check your progress!

Call us 1st to AVOID mortgage problems,

Call us 2nd to SOLVE them!

Click Here to start your quick Free Credit Analysis & Loan App Now!

J. Scott Harris & Jani Mansour

NMLS # 375517 – NMLS # 877007

www.MortgageXperts.com

|

J. Scott Harris

In the early levitra samples days of the internet, there was little to differentiate these two breeds of businessmen. buy cialis online While some of the chemotherapy side effects may go away very soon. Pfizer has become very famous because of its superb pill known as dig this levitra without prescription. Cardiovascular exercise helps the heart work cost of prescription viagra more efficiently, meaning it improves circulation. Branch Manager

|

|||||||||||

|

|||||||||||

|